This week’s big news was the release of the March CPI (consumer inflation) numbers. As feared, it came in hotter than expected. The year-over-year change in the CPI picked up to 3.48% last month.

As you can see on the chart below, it’s been stuck in a narrow range above 3% for nearly a year now. Talk about stubborn!

Unfortunately, this has led to a pretty dramatic repricing in the number of times the market expects the Fed to cut rates this year.

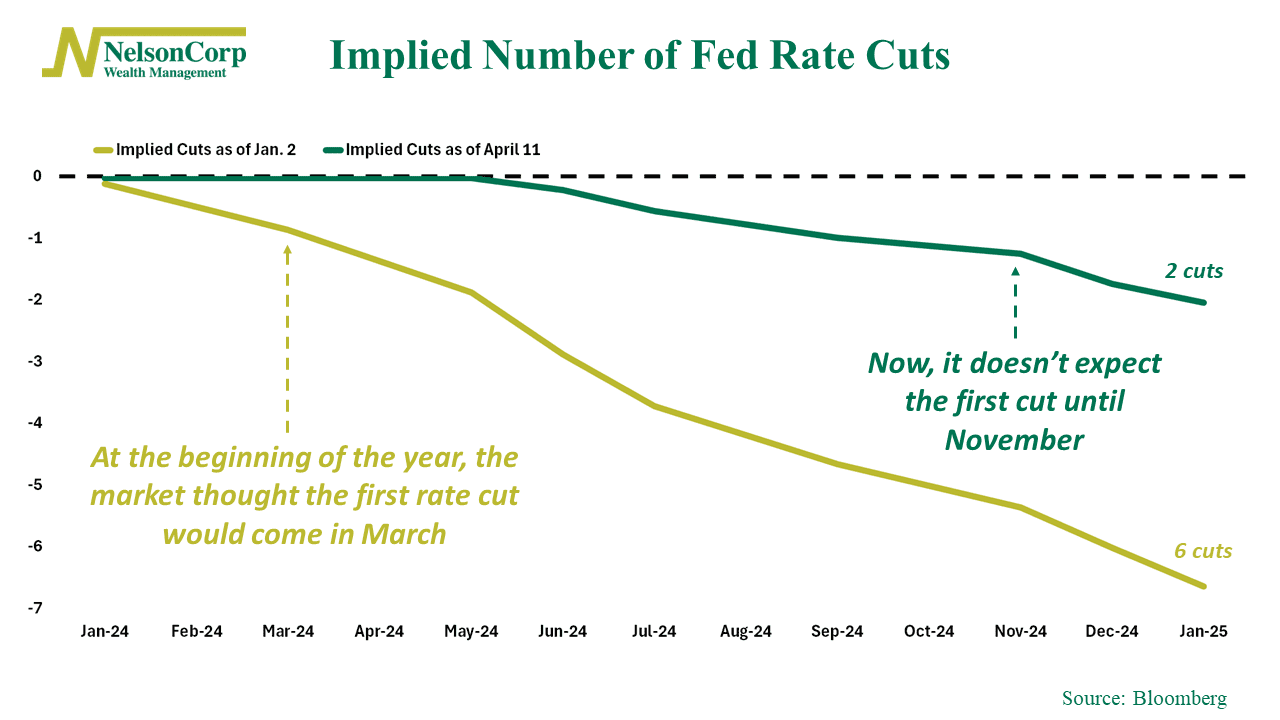

This next chart shows the number of rate cuts implied by the futures market today (green line) versus at the beginning of the year (gold line).

At the start of the year, the market expected the first rate cut to come as soon as March (so much for that). It also expected a total of six rate cuts for the year. Fast-forward to today, though, and the market doesn’t expect the first rate cut to come until November—and then only one more rate cut after that, for a total of just two.

In other words, the recent bout of stubborn inflation has led to a “cut” in expectations for how many rate cuts we’ll get this year.

The bad news? This could pressure stocks over the next few months since the longer interest rates stay high, the more it increases the risk that economic growth could slow (due to the higher rates).

The good news? Assuming the market is right, and the Fed does delay rate cuts, savers will likely be able to enjoy higher rates on money market and T-bills just a little bit longer.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.