There’s this saying on Wall Street that copper is the commodity with a PhD in economics. Why? Because it’s an industrial metal that sees its demand wax and wane with economic growth. The higher the growth, the higher the demand for copper, and vice versa.

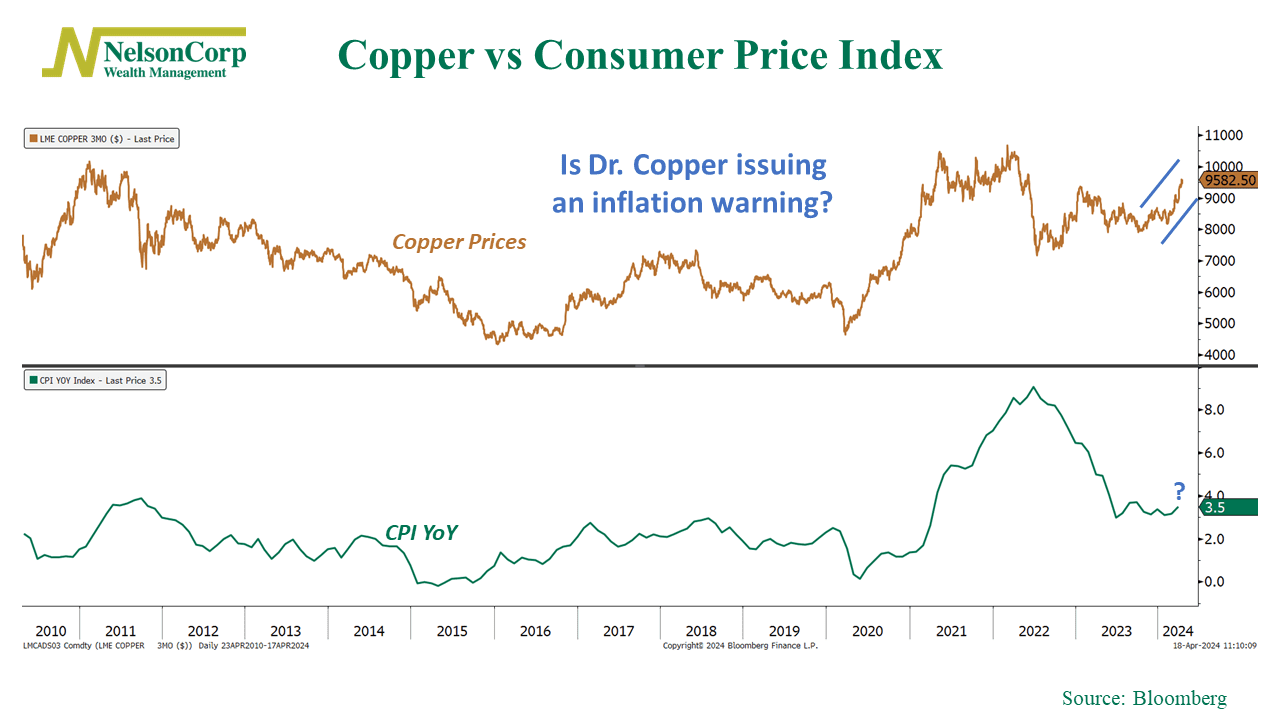

Well, in that same vein, we’ve also found that Dr. Copper tends to do a good job of predicting where inflation is headed, too. For example, the chart above shows the price of copper along with the annual growth rate in the Consumer Price Index (CPI). Just eyeballing it, you can see how the CPI tends to echo copper’s movements pretty closely, with copper prices leading the CPI by about two months.

That’s why the recent resurgence in copper prices is so concerning. The latest CPI reading for last month caught many by surprise, but it mostly reflected an up move in copper prices that began a few months ago. If copper prices continue to climb from here, it could very well mean that inflation will be stuck or even rise more in the coming few months. For risk assets, like stocks, that would probably not be a welcome occurrence.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.