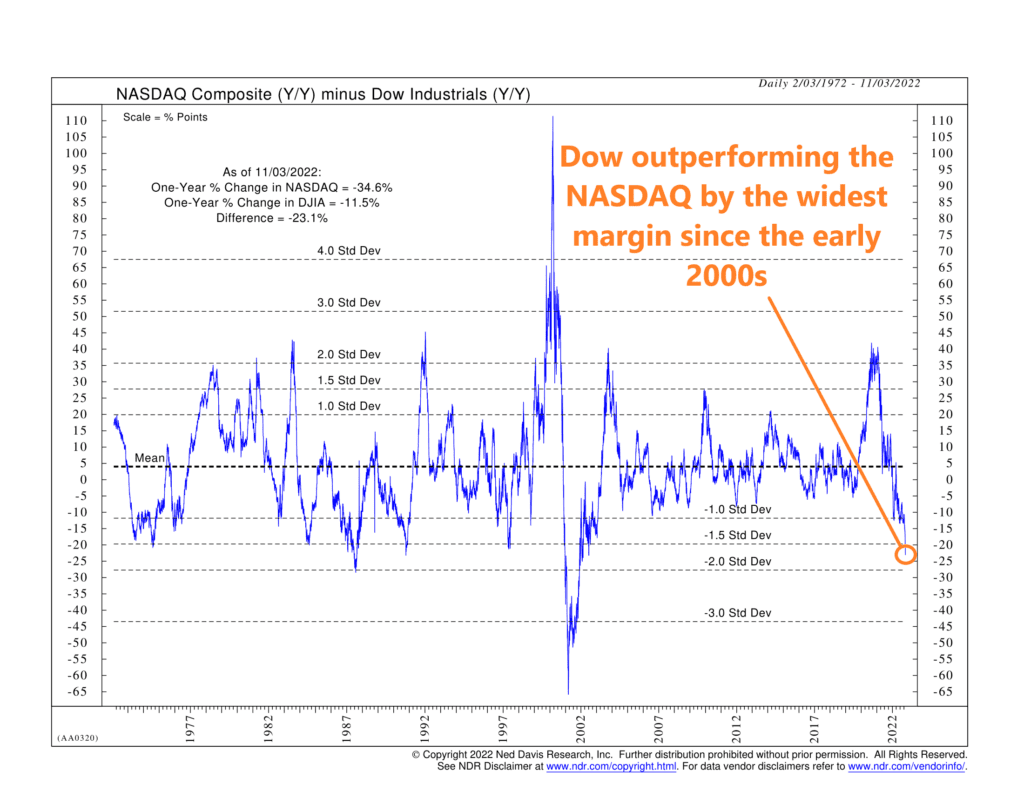

This week’s featured chart compares the annualized returns of two of the most popular stock mark indexes in the United States: The NASDAQ Composite and the Dow Jones Industrial Average.

The blue line represents the annualized returns of the NASDAQ composite minus the Dow, going back to 1972. A rising line means the NASDAQ is outperforming the Dow—and vice versa.

We measure this because of how different these two indexes are and what their relative performance means for the overall stock market.

The NASDAQ Composite represents the performance of all the stocks on the Nasdaq stock exchange. In general, these tend to be companies in the information technology sector. In other words, think of them as high-flying tech stocks.

The Dow, by contrast, is a much older stock market index that combines the stocks of just 30 of the most prominent companies in the United States. You’ve probably heard of many of the stocks in the Dow—they’re the blue chips. They tend to have a long history of profitability and come from different economic sectors.

In the financial world, we tend to equate the NASDAQ to growth stocks and the Dow to value stocks. This is an important distinction because growth stocks are expected to grow their revenues and earnings faster over time. However, the longer that time horizon is, the more interest rates affect their valuation today.

This explains what we see today on the chart. In 2020 and 2021, the Fed slashed interest rates to stimulate the economy. These lower rates boosted the valuations of the growthy NASDAQ stocks, so the relative return measure shown above skyrocketed upwards.

But now, the opposite is occurring. The Fed is aggressively raising rates to tamp down inflation, and these higher rates are throwing cold water on the NASDAQ’s valuations. As a result, the Dow is down around 12% on an annualized basis this year, versus the nearly 35% decline for the NASDAQ. That 23% return differential is the lowest since the Dot-Com bust in the early 2000s.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.