Let’s say you’re a big company and need to raise some cash. You’ve generally got two options: borrow money or sell a piece of your company.

Borrowing money has largely been the go-to choice for the past couple of decades. That’s because not only is the interest on debt typically tax-deductible, but interest rates on bonds themselves were super low.

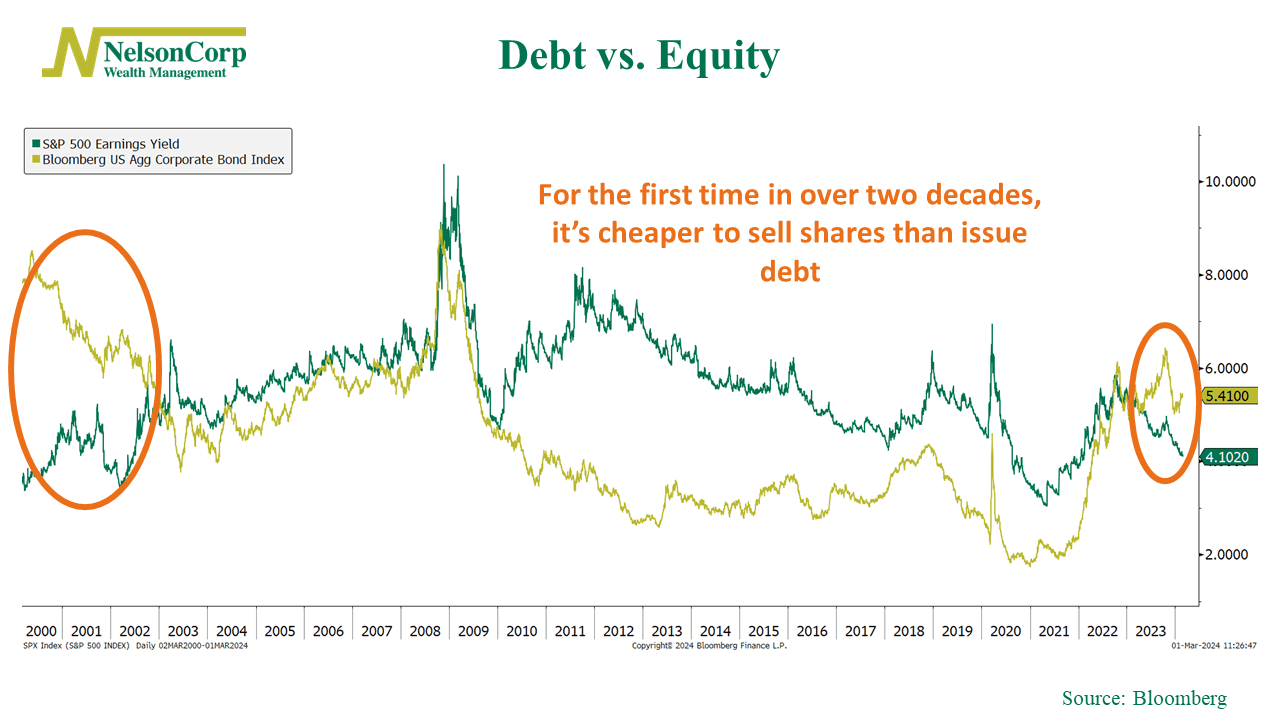

But now, things are changing. According to our featured chart above, for the first time since the early 2000s, it’s actually cheaper for top-notch companies to sell shares of their company rather than take on debt.

On our chart, we have the earnings yield of the S&P 500 (the green line), which tells us the cost of selling shares. The lower the percentage, the cheaper it is to sell shares. And for the cost of borrowing money (that’s the gold line), we’ve looked at the average interest rates on corporate bonds. As you can see, the earnings yield (cost of equity) has fallen to just a little over 4%, while bond yields (the cost of debt) have doubled over the past two years to around 5.5%.

What does this mean? Well, one way to see it is that stocks might be overvalued compared to corporate bonds, which could lead to some competition for investor dollars. That’s the gloomier take.

But here’s the brighter side: maybe more of the younger, early-stage growth companies will start selling shares and going public now. If so, it could help balance the public stock market, which the big players currently dominate.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. Investment grade, fixed rate bond market securities, including government agency, corporate and mortgage-backed securities.