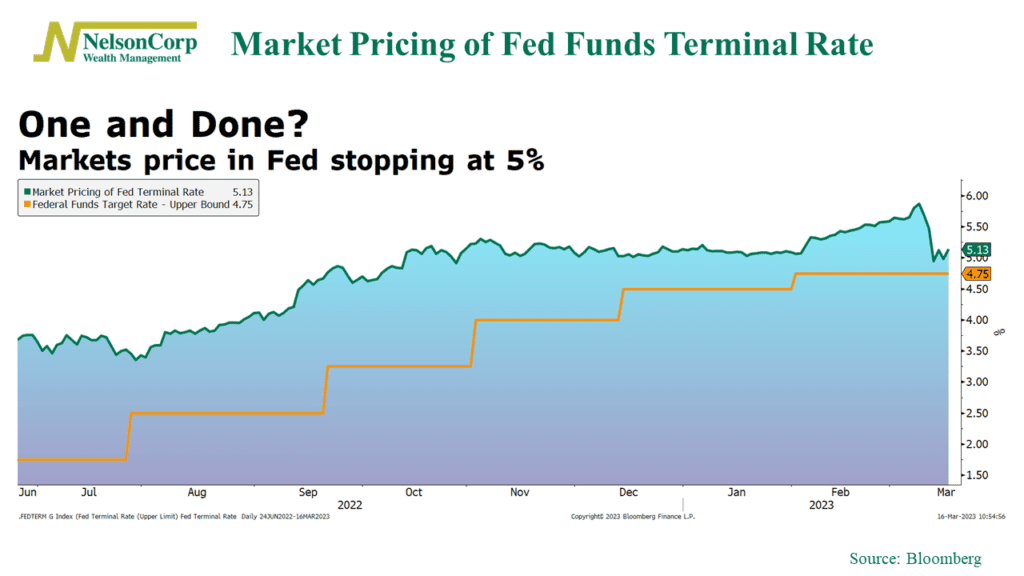

I’ve got a couple of charts this week showing just how quickly expectations can change in financial markets.

The first chart, shown above, compares the market’s expectations for the terminal level of the federal funds rate (green line) vs. the current target rate (orange line). Just a week or two ago, the market had priced in its expectation that the Fed would raise its target rate to nearly 6%. But then some high-profile banks failed, and some economic data came in cooler than expected. And now, the bond market thinks the Fed will probably hike one more time—by 25 basis points—and then call it quits.

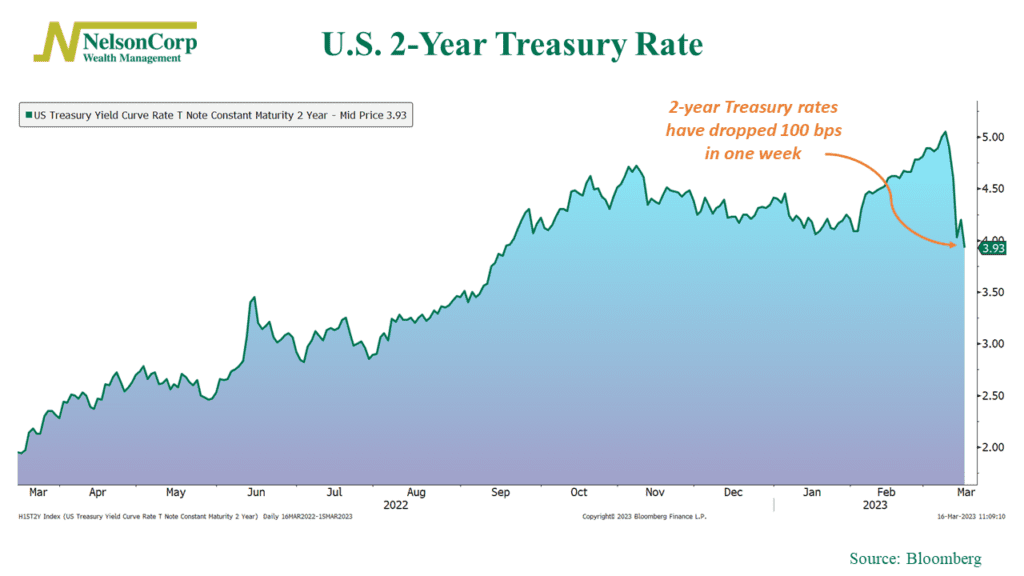

On top of that, we’ve seen the 2-year Treasury rate absolutely collapse. The 2-year Treasury rate—shown above—has dropped roughly 100 basis points in just one week. This is significant because the 2-year rate is a rough proxy for where the Fed is headed with interest rates. And right now, a 2-year rate of roughly 4% implies that the Fed will likely cut—that’s right, cut—rates before the year ends.

The bottom line? Expectations can change quickly in the markets. The Fed is arguably the most important player in financial markets, so expectations around its intentions matter—a lot. The flurry of rate increases last year pummeled stocks. So, if the Fed does shift from hiking rates to holding steady or even cutting, that’s a big deal.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.