The clock is ticking for the U.S. government’s finances.

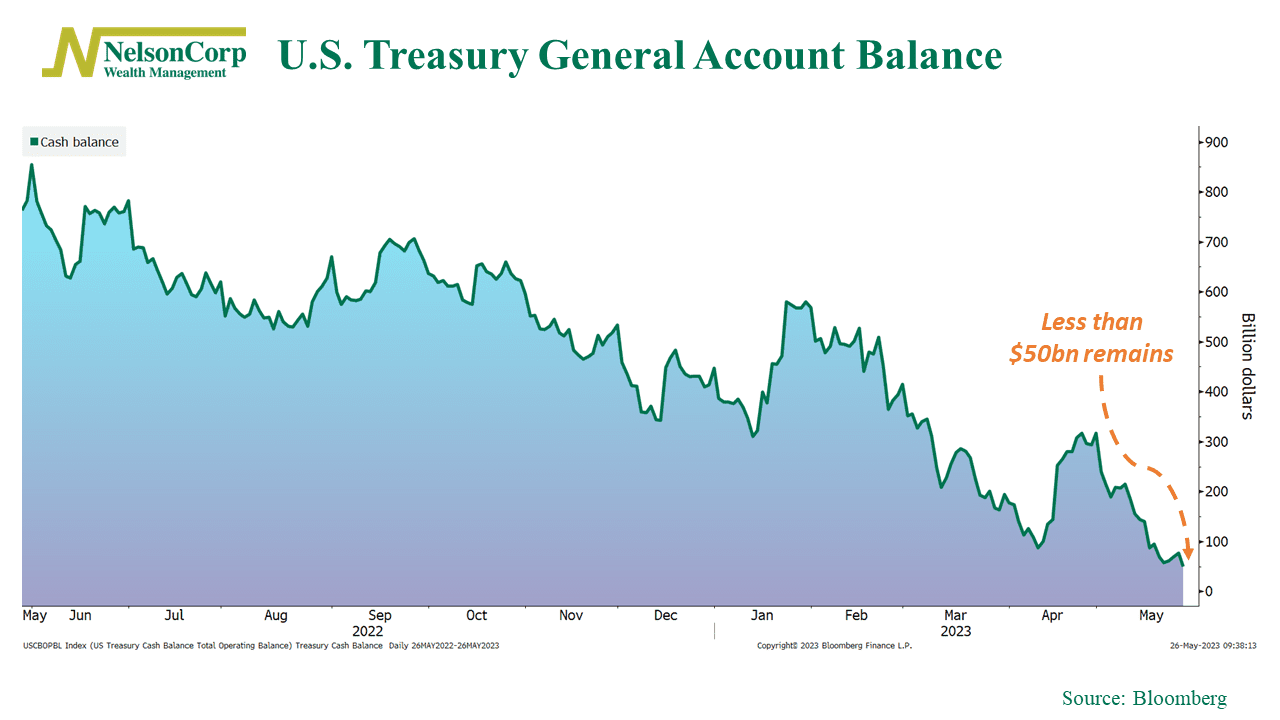

As our featured chart above shows, Uncle Sam’s checking account—something known as the Treasury General Account—is quickly shrinking. This week’s latest update showed the balance dropping to less than $50 billion, its lowest level since the debate over raising the debt ceiling began. In the past decade, the Treasury’s cash balance rarely fell below $50 billion.

The so-called “X-date,” when the Treasury’s cash balance drops to zero and a technical default occurs, could arrive as early as next week. This event would likely result in significant volatility for financial assets, which is something I’m guessing investors would like to avoid.

The potential good news, however, is that, at the time of this writing, it does appear that some concrete details of a possible debt-ceiling deal have appeared, even if it’s not a sure thing that any agreement will ultimately stick.

The bottom line? If a deal is reached, it could be a catalyst for a market rally in the second half of the year. But if no agreement is reached, we should probably brace ourselves for some potential market volatility in the short term.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.