The British pound—the currency of the United Kingdom—was the star of the show of the financial world this week. It made the news because the leaders of the U.K.’s new government laid out a plan to cut taxes and pay for it by borrowing roughly £45 billion over the next few years.

But investors swiftly gave the new fiscal plan a big thumbs down, sending government bond yields higher and the pound lower.

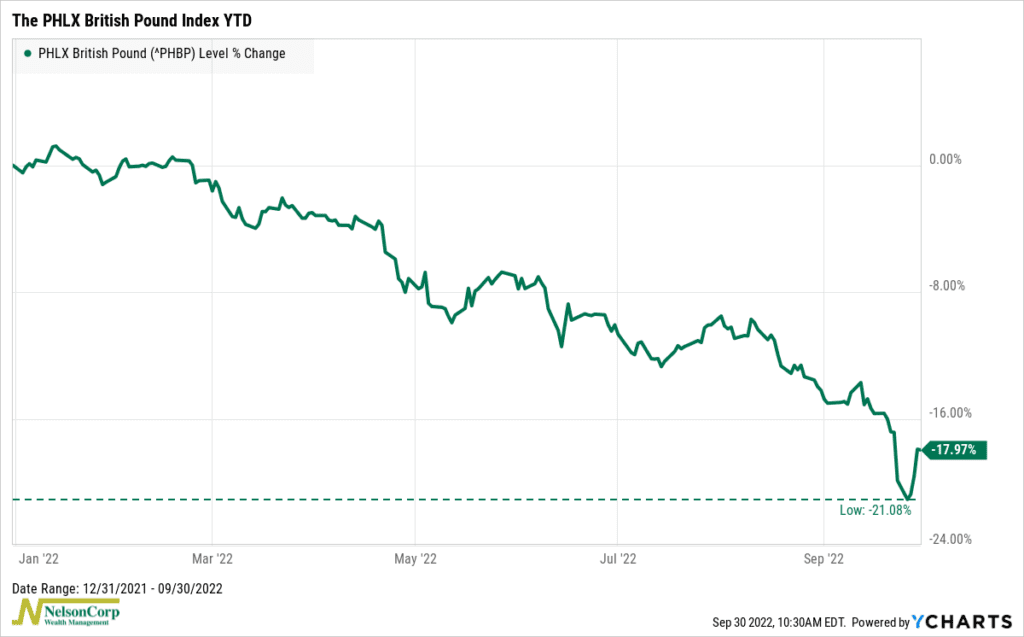

Our featured chart above shows the year-to-date return of the PHLX British Pound Index, a measure of the pound’s strength relative to the world’s major currencies. At its lowest point this week, it was down more than 21% for the year. It has since recovered some of the losses from earlier in the week, but it is still down around 18% this year.

So, it’s not just the fiscal plan that has hurt the pound’s value this year; our chart shows it has been weakening all year. What else could be driving this weakness?

Well, it’s important to remember that it’s all relative when looking at the return of something like a country’s currency. This means that for one currency to lose value, another one must gain value. In the case of the British pound this year, the U.S. dollar has been the primary beneficiary. In fact, you would be hard-pressed to find a currency that has outperformed the dollar this year; it’s up nearly 17% year-to-date.

A big reason for the dollar’s strength is that, economically, the U.S. is just in a much stronger place than other parts of the world—Europe in particular. And when it looks like global growth is set to slow, investors flock to the safety of the U.S. dollar, which also happens to have the coveted privilege of being the world’s reserve currency. Throw in seemingly unpopular fiscal policies like the one enacted in the U.K., and it’s a recipe for an even stronger dollar.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.