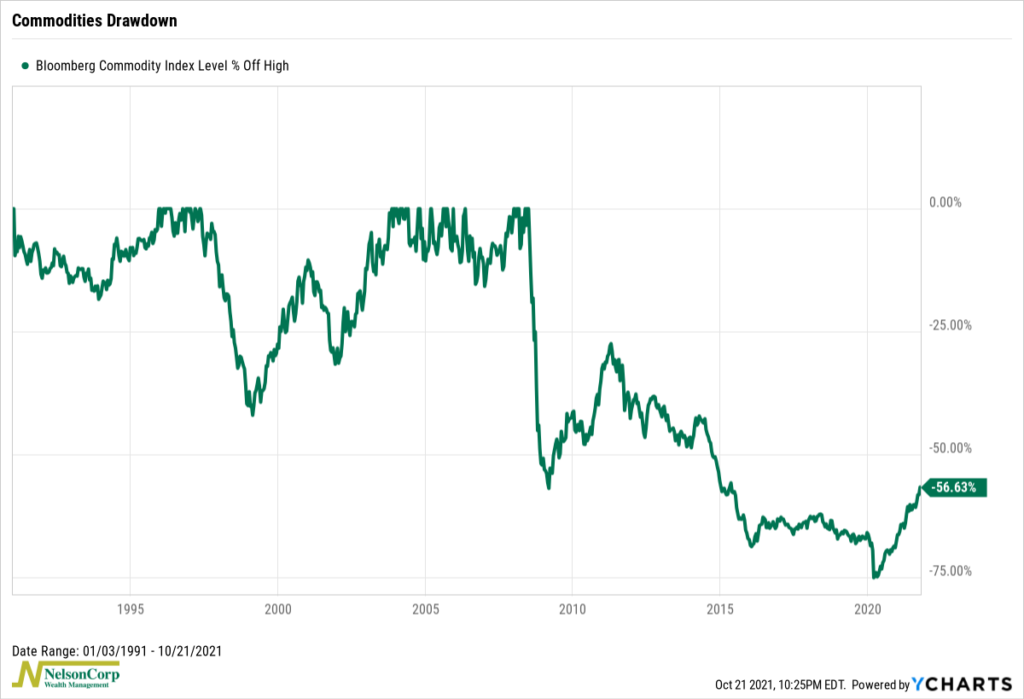

This week we look at a chart of the Bloomberg Commodity Index, a benchmark index that tracks the performance of the entire commodity market. The index itself is broken down into six major commodity groups: energy, grains, industrial metals, precious metals, softs, and livestock. Energy makes up most of the index, with a nearly 30% weighting. Grains come in second, with about a 23% weighting, and livestock brings up the rear, using up just 6%.

You probably aren’t surprised to hear that commodities have been on a tear lately, given all the supply chain issues and supply shortages. The index has certainly had quite the run, surging more than 70% since the March lows last year.

However, our chart above presents the index in the form of a drawdown chart. This type of chart shows the percentage the index is down from its all-time high. The series goes back to 1991, and as you can see, the index hit an all-time high back in the Summer of 2008, before the Financial Crisis hit. It has yet to recover. Even with the big gain this year, it is still nearly 57% underwater.

There’s a couple of takeaways from this. One is that, over the long-term, investing in commodities has been a pretty poor investment—the broad commodity index has only returned about 4% total in 30 years! With that said, however, there have still been plenty of opportunities over this same period to make significant returns—it just requires taking a tactical investment approach to the endeavor to be successful.

The other takeaway is that even after such a huge run the past year and a half, there could still be plenty of room for commodities to run higher, given they still aren’t anywhere near the highest point they reached back in 2008. Now, I’m not saying that necessarily has or will happen, but the possibility is there.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.