The big financial news this week was all about the Federal Reserve’s meeting on Wednesday. Pretty much everything happened as expected. The Fed decided to keep its policy rate steady at 5.5% for now, but they’re still thinking about cutting rates up to three times later this year.

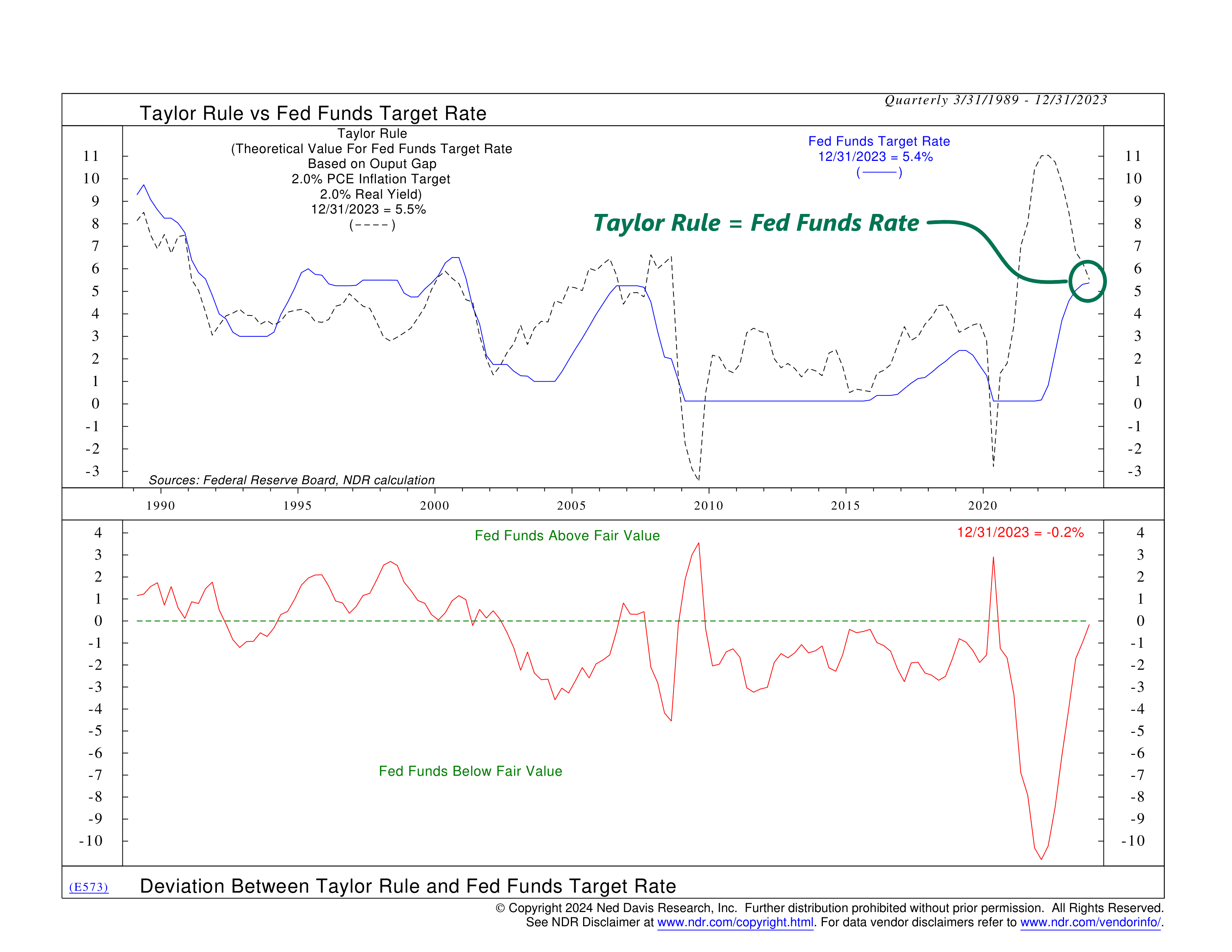

According to the Taylor Rule, this is probably the right decision.

What is the Taylor Rule? No, it has nothing to do with Taylor Swift. It’s actually a fancy mathematical guideline (developed by the economist John Taylor) that central banks use to determine the appropriate level for short-term interest rates in the economy. It’s kind of like a recipe for baking a cake. It tells you how much sugar to add based on how sweet you want your cake to be. But instead of sugar, the Taylor Rule uses two primary inputs—the inflation rate and an economic concept called the output gap—to determine where the Fed’s policy rate should be to maintain long-term growth and price stability in the economy.

I won’t bore you with the specific mathematical calculation, but as you can see on the chart above, the Taylor Rule’s estimate for where rates should be (the black dashed line) now matches up perfectly with the current Fed Funds rate (blue line). This is important because, as highlighted on the chart, the Fed got way behind the inflation curve in 2021. The gap between where the Taylor Rule said rates should be and where they actually were was the largest on record.

Today, however, the risk runs in reverse. Will the Fed stay too tight for too long, given the continued decline in the Taylor Rule’s estimate? It’s hard to be sure. The Fed thinks staying steady now with rate cuts later this year is most appropriate. The Taylor Rule seems to be trending in that direction as well. So, at least for now, the Fed and the Taylor Rule are in sync—and the market seems to like that.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.