When markets get shaky, the weakest links usually show it first—and nowhere is that more obvious than in junk bonds.

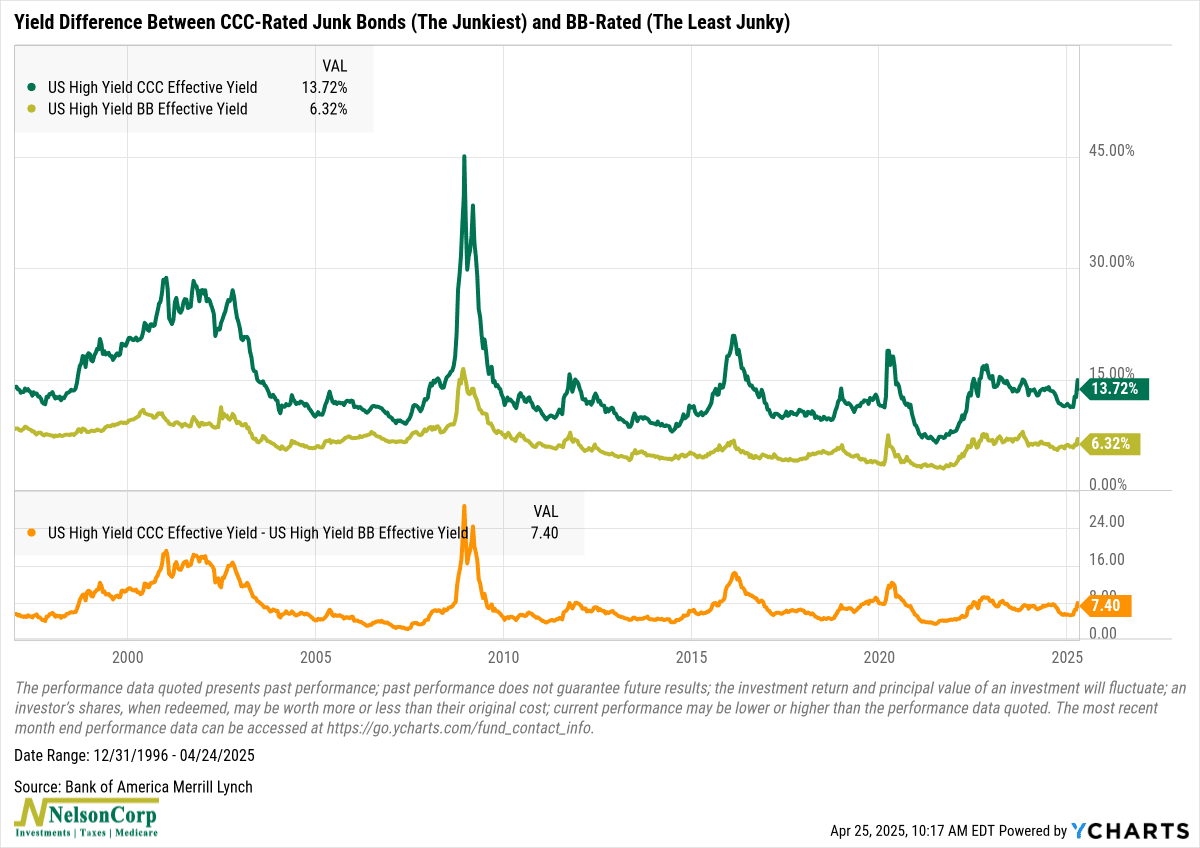

This week’s chart is a favorite of DoubleLine’s Jeffrey Gundlach. It compares the yields on CCC-rated bonds—the riskiest junk out there—with BB-rated bonds, which are still junk, just a little less junky. Basically, it shows how much extra return investors are demanding to take on the worst credit risk.

Right now, that spread is sitting at 7.42%. Relatively speaking, it’s not that high. But it has been creeping up from low levels, which suggests investors are getting a bit more cautious about credit risk.

The good news? We’re nowhere near the kinds of spikes we’ve seen during big stress events over the past couple decades. But it’s still something to keep an eye on. When cracks start to form in the junk bond market, they can spread—and the stock market usually doesn’t get a free pass when that happens.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.