At the latest Federal Reserve meeting, chairman Jerome Powell mentioned that inflation continues to “move down gradually on a sometimes bumpy road to 2%.”

Why is 2% such a big deal? Well, hitting that target gives the Fed the green light to consider cutting interest rates later in the year—a move that would likely make the stock market pretty happy.

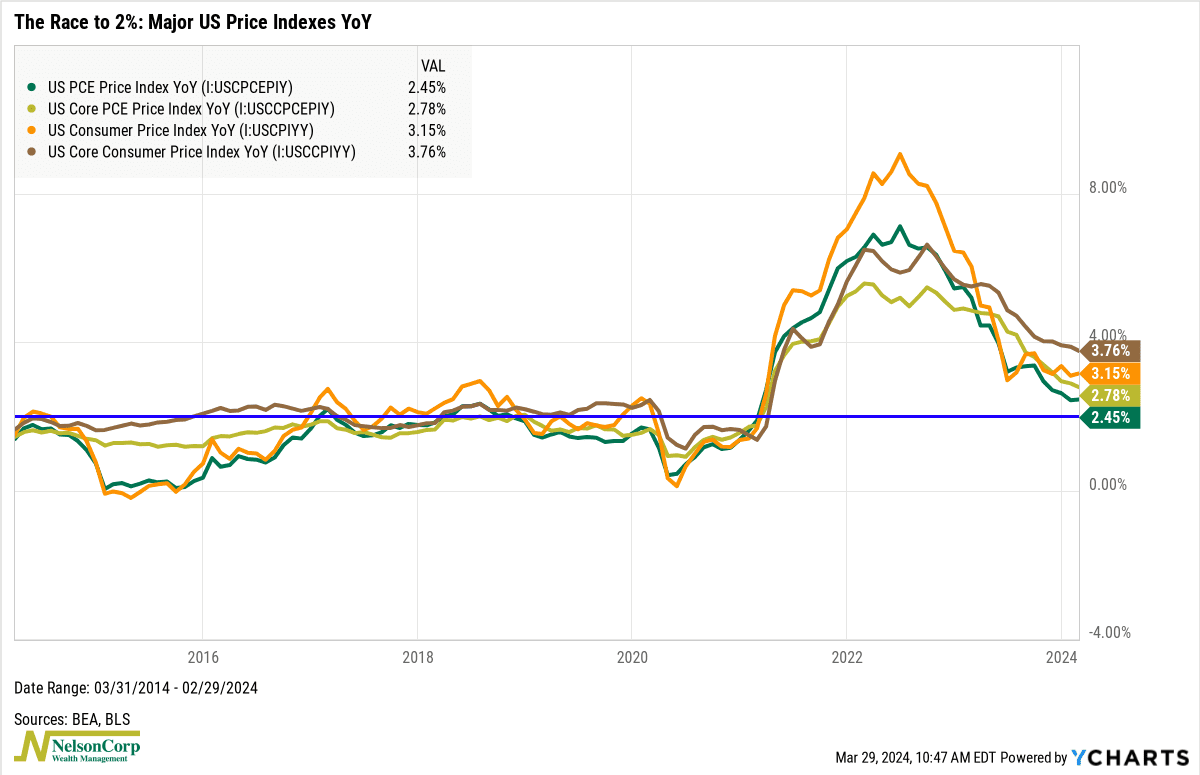

There are several ways to measure inflation—I’ve plotted four of them on the chart above—but one of the most important ones is the U.S. PCE Price Index. This is the Fed’s favorite yardstick for inflation (along with the core version). It rose 0.3% last month, and compared to a year ago, it rose 2.45% (shown as the green line on the chart above).

In other words, when it comes to getting to 2%, the Fed’s preferred measure is winning the race. It’s still got some work to do, and the recent monthly changes have been higher than expected, but things seem to be trending in line with the Fed’s expectations.

As long as this trend holds, it sets a nice stage for stocks to continue doing well. But if we see a surprise spike in inflation down the road, it could dampen the stock market rally.

The bottom line? Inflation will remain a top-shelf indicator to keep an eye on for the rest of the year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.