The latest jobs report brought some interesting insights into our economy. In October, the unemployment rate rose to 3.9%. While still low by historical standards, it is a notable increase from the 3.4% low in April. A jump this size often raises fears that a potential recession is on the horizon.

That raises the question: should we be concerned?

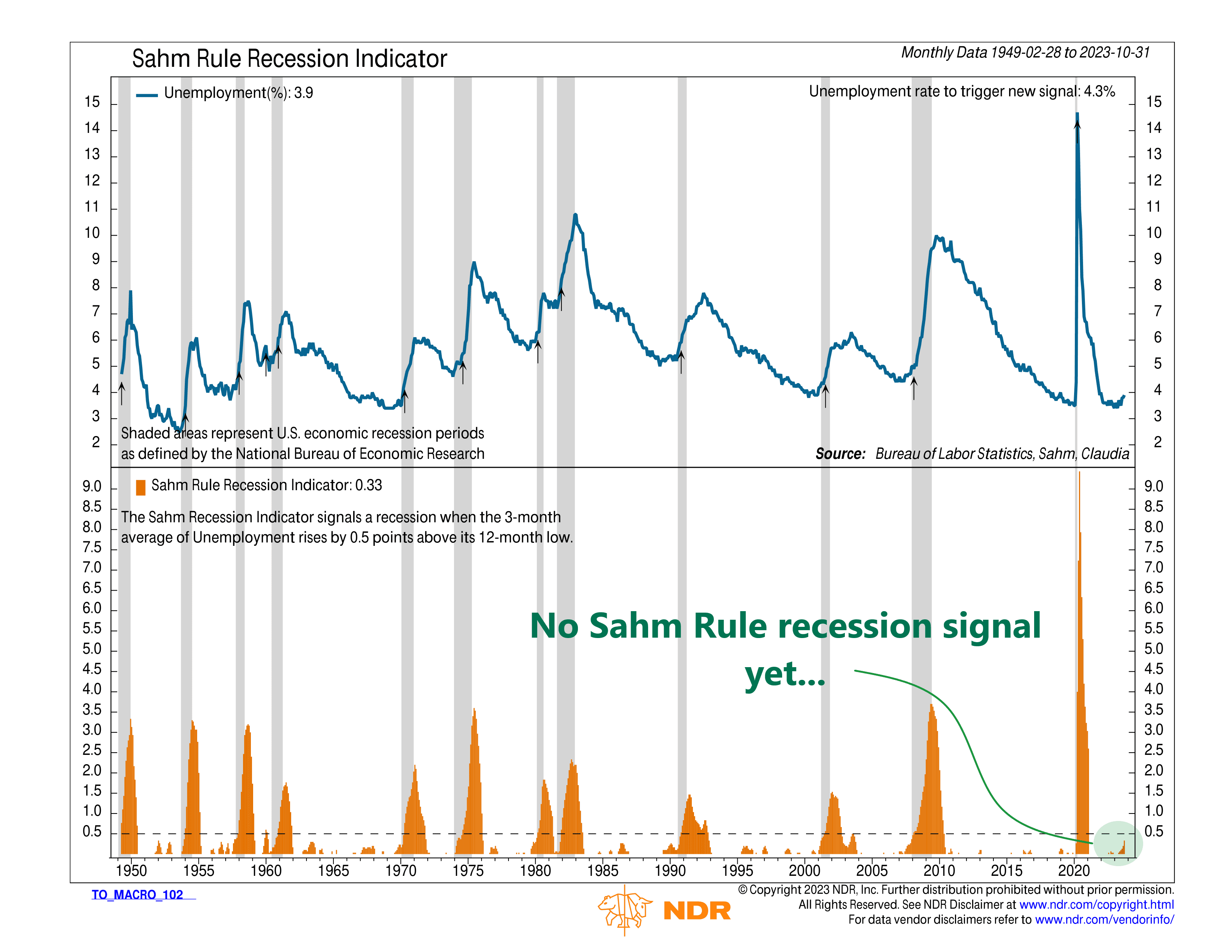

Enter the Sahm Rule, a handy guideline created by former Fed staff economist Claudia Sahm. According to the rule, if the 3-month average of the unemployment rate increases by 0.5 points from its 12-month low, it’s a strong indication that a recession is already in progress.

As you can see from our chart above, the indicator is currently 0.33, which is still below the recession threshold. That’s encouraging news.

The not-so-great news, however, is that once the indicator reaches levels this high, there’s historically been a good chance it will keep climbing.

That would be somewhat concerning, as the Sahm Rule has a strong track record of accurately predicting every recession since 1950. While it’s not there yet, the fact that it’s on the rise suggests it’s time to pay attention.

A potential optimistic note to consider, however, is that even Claudia Sahm herself recently acknowledged the possibility that the pandemic may have broken her indicator, like so many other indicators affected by the pandemic. If true, that would be a positive sign for the economy.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.