A lot of money flowed into financial products in 2021, but investors made it clear which investment vehicle they preferred the most: the ETF.

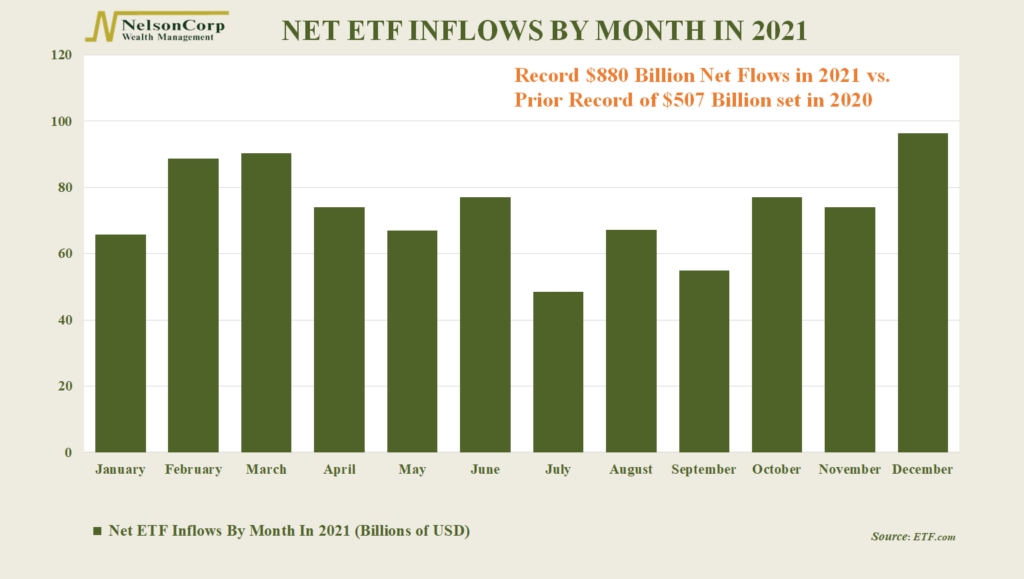

As our chart above reveals, ETFs saw a record $880 billion inflow of new money this year, beating the previous record of $507 billion set last year.

And the flows weren’t just big; they were consistent, too. Each month, investors put anywhere from $45 billion to nearly $100 billion into ETFs. That’s a lot of cash to put to work every month!

ETFs (Exchange Traded Funds) aren’t new; they’ve been around for more than 20 years. But there are two big reasons why investors have been favoring them over other investment vehicles like mutual funds in recent years.

The first has to do with how an ETF trades. Unlike a mutual fund, which only trades once a day, an ETF trades all day, just like a stock does. This is appealing to both retail and institutional investors as it provides a lot of flexibility in determining how and when to make allocation decisions.

The second reason an investor might choose an ETF over a mutual fund is its inherent tax advantages. A mutual fund must pay out its trading gains as a distribution to shareholders, resulting in a taxable event when it occurs. An ETF, on the other hand, has a process in which it can shed its gains without resulting in a taxable event to the shareholders. An investor can realize gains on their own terms—only when they choose to sell the ETF itself.

Given these advantages, ETFs have proven their worth to investors. And it’s not hard to imagine them attracting even more money at the expense of mutual funds in the coming years.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.