What do you get when you combine dirt-cheap funding with a preference to invest in companies heavy on intangible assets? Two words: zombie companies.

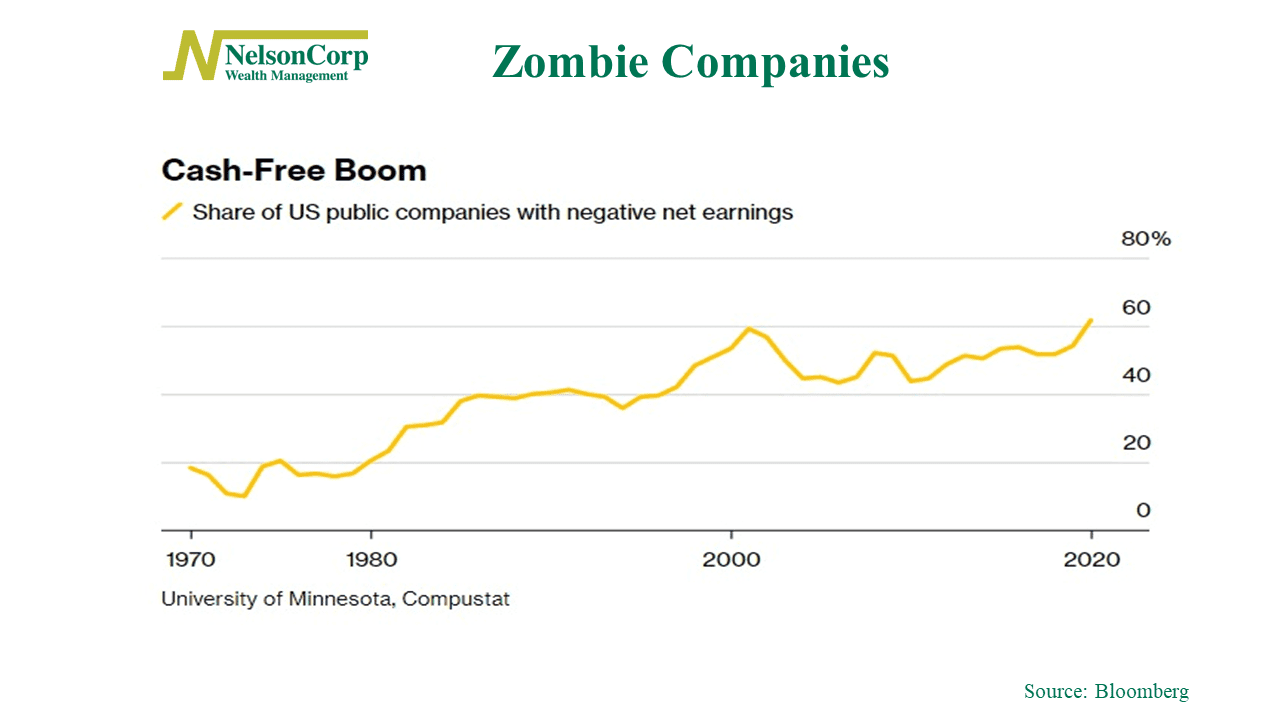

According to a new research paper by the University of Minnesota, the percentage of U.S. public firms with zero earnings has tripled over the past five decades. In 1970, they accounted for just 18% of the total. Today, they make up roughly 62% of the group, as shown above.

These so-called “zombie companies” have negative net earnings, meaning after paying the interest on their debt, they have negative earnings left over. This makes them heavily dependent on low-interest rate environments, such as the one the Federal Reserve fostered coming out of the Great Financial Crisis.

But that easy-money era appears to be ending. The tide of easy monetary policy is going out, and liquidity is draining from the system. These days, investors prefer cash-rich companies over those ladened with intangible assets that promise profits further out in the future. As rates have moved higher, these loss-making firms have erased many of their pandemic-era gains.

Of course, there will still be some big public companies—with solid business models—that go on to survive once it’s all said and done. And with the way our society has changed, intangible assets are much more common in our economy today than they were five decades ago.

So, it’s not just an easy-money phenomenon. And we will likely see more highly valued firms with negative net earnings in the future than what we’ve been used to historically.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.