Investors often assess a company’s earnings in two ways: by looking at its trailing earnings (the past) and its future earnings (expected). This week’s indicator looks at a combination of both to understand how they influence stock returns.

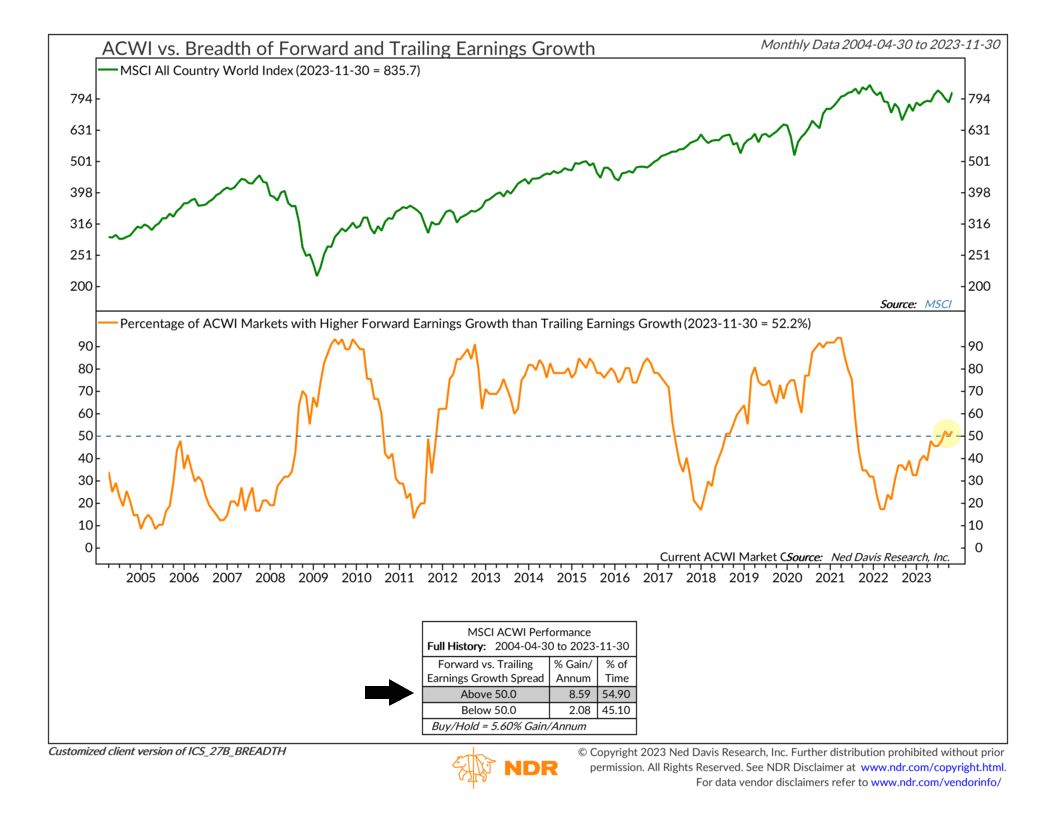

At the top, we have the MSCI All Country World Index, a good proxy for global stock returns. The bottom part shows the percentage of ACWI markets with higher forward earnings growth compared to trailing earnings growth. Essentially, it indicates how many markets are anticipated to grow their earnings faster than they did in the previous year.

You might expect that higher expectations for earnings growth relative to the past would be positive for stocks overall, and you’d be right! As shown in the performance box at the bottom of the indicator, when more than 50% of countries have higher forward earnings growth, it historically leads to annualized returns of around 8.6% for global stocks. Below 50%, however, the return drops to just 2%.

Looking at recent history, you can see where this measure dropped below 50% in late 2021, right before the global stock market sold off in 2022. This indicator was warning that global earnings growth was poised to decline broadly relative to where it had been—and that was bearish for stocks.

Fast forward to today, though, and we have better news. The indicator recently rose above 50%, a sign that the majority of stock markets around the world are seeing forward earnings growth that is higher than their historical earnings growth—a bullish condition.

The bottom line? Earnings are an important driver of stock market returns. This indicator offers a unique perspective on the breadth of earnings growth, and when combined with other indicators, it can help investors figure out what’s going on in the market.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.