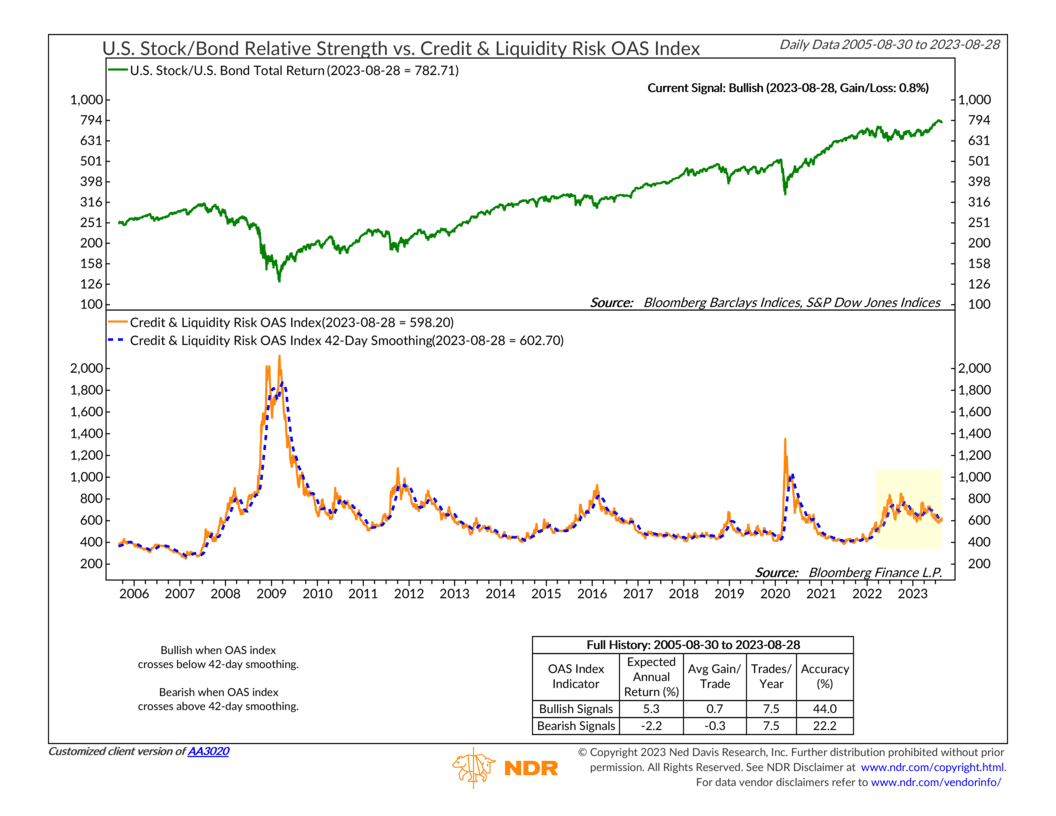

This week’s indicator features the Credit & Liquidity Risk OAS Index (orange line, bottom clip), which is an index that packages credit spread risk into one neat little metric. It rises when credit spreads widen and falls when credit spreads narrow.

But what is credit spread risk, and why is it important?

Well, in this case, credit spreads are the difference in yield between corporate bonds and government bonds of the same maturity. When investors get nervous about the state of the economy, the distance between these yields widens as investors flock to the safety of government bonds (sending those yields lower) and sell riskier corporate bonds (sending those yields higher).

Pretty consistently, we tend to see credit spreads widen when an economic recession is right around the corner. So, credit spread risk is simply the risk that an economic slowdown is coming because credit spreads are widening.

A big worry going into this year was that we might indeed fall into an economic recession, and credit spreads started to move higher in anticipation of that increasing risk.

However, as I’ve highlighted on the chart, the Credit & Liquidity Risk OAS Index has gradually fallen all year. It’s well off its twin peaks in 2022 and is currently at its lowest level since before the regional banking crisis earlier this year.

Not only is this a good sign for the economy, as it suggests recession risk is low, but it’s also good for the stock market. Historically, when the indicator is below its 42-day smoothing (blue dashed line), the S&P 500 index (green line) has had superior returns versus when the indicator is rising relative to its smoothing.

The bottom line? Recent trends suggest that credit spread risk is falling, which also indicates that the risk of a big credit event in the economy is falling—and that is all potentially good news for stock investors.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.