This week’s indicator focuses on two important stock market forces: upside breadth and momentum.

A stock with momentum means it is trading at a higher price level compared to its recent past. So, for the stock market as a whole, we want to see a lot of stocks moving higher relative to their recent price history for us to say the market has strong upside breadth and momentum.

When it happens to an extreme extent, we call it a “breadth thrust.” And typically, the market tends to see further gains after a breadth thrust occurs.

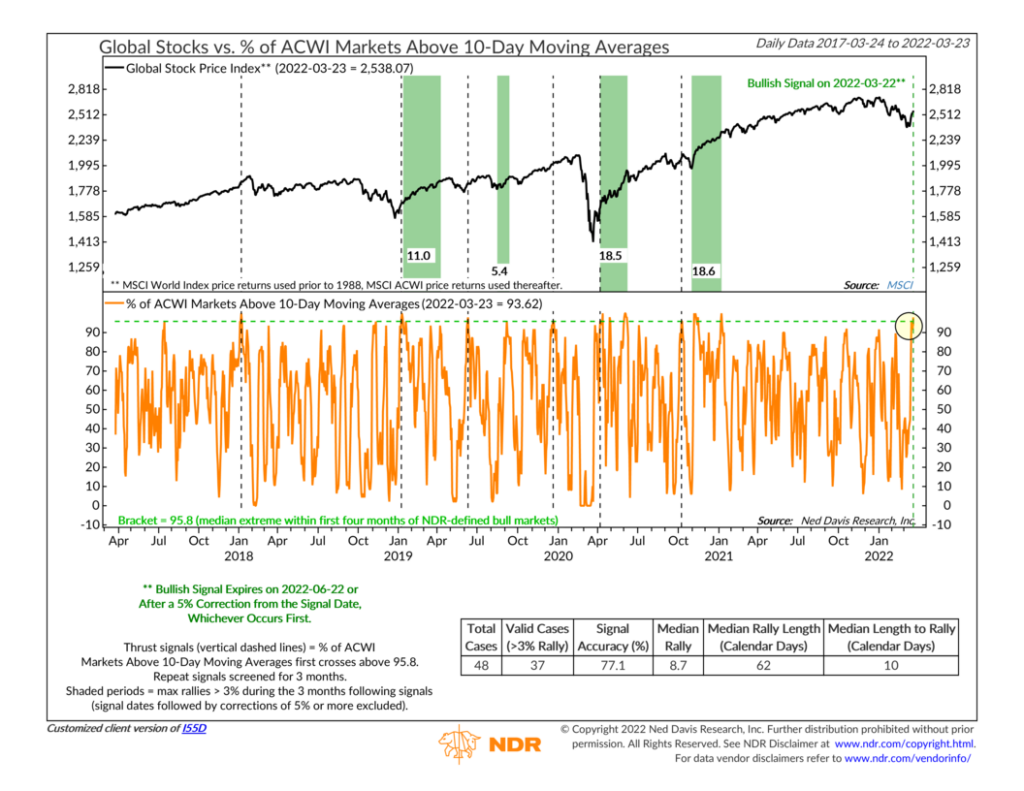

Our indicator above measures breadth thrusts on a global scale. It uses the MSCI All Country World Index (black line, top clip) as a proxy for the global stock market. In the bottom clip, the orange line calculates how many markets in the global index are trading higher than their average 10-day price. This is the upside breadth and momentum part. The higher the line, the more breadth and momentum global stocks have.

Historically, the tipping point has occurred when more than about 96% of global markets are trading above their average 10-day level. A bullish thrust signal is generated when this tipping point is breached for the first time in at least three months. Over the next three months, if the market rallies another 3% (without a 5% correction), it typically has an overall gain of just under 9% during the three months after a bullish signal is triggered.

I’ve highlighted on the chart that a bullish thrust signal was generated this week. A week ago, under 50% of global markets traded above their average 10-day price. By Tuesday, however, that number had climbed to nearly 98%—thus generating the bullish signal.

That’s quite a shift in market breadth and momentum. Now we will watch to see if the market goes on to rally at least another 3% (without falling 5% in the interim). If it does, there’s a good chance that global stocks will produce a significant gain over the ensuing three months or so.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.