Commodities have been on fire lately. In particular, we’ve seen raw materials like copper, oil, and gold do really well. What’s going on? Well, it appears investors are betting that strong economic growth around the world will continue to boost global demand for these hot commodities.

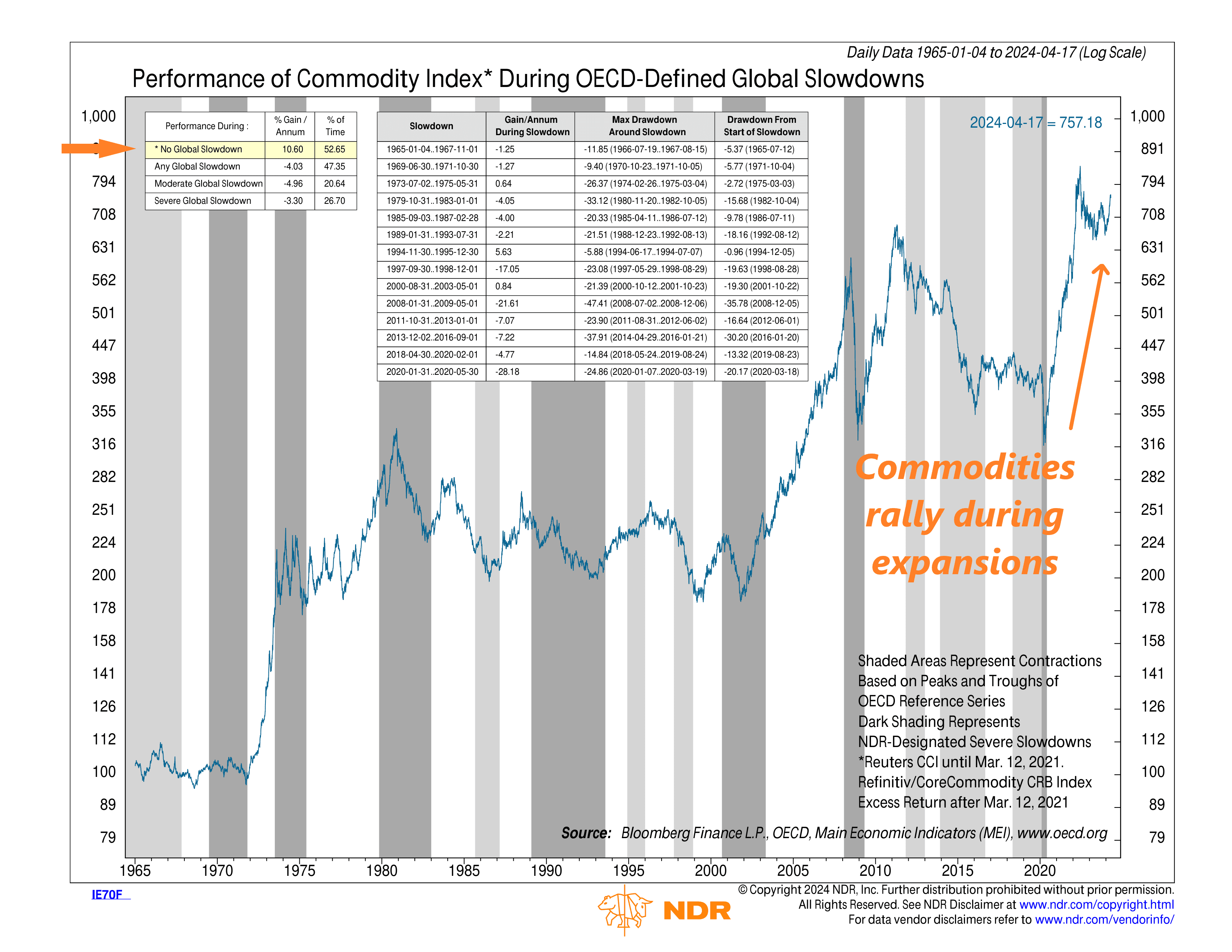

Our featured indicator this week, shown above, illustrates this concept nicely. It shows how commodities have typically performed during OECD-defined global slowdowns, with the shaded areas representing periods of slowing economic growth.

As you can see, commodities tend to perform poorly when global growth is slowing. This makes sense. When the economy is slowing down, the demand for raw manufacturing materials tends to be low. However, when the economy expands, demand for those raw inputs increases, so commodity prices rally.

In the top left corner of the indicator, we can see how the commodity index has performed during the various global growth regimes, ranging from no global slowdown to a severe global slowdown. As expected, when there is no global slowdown, the commodity index has increased at a 10.6% annualized rate. Get any sort of global slowdown, however, and those returns turn negative.

The takeaway for investors? Commodity prices tend to set the tune for the global economy. And right now, commodity prices are rallying, suggesting the global economy remains in pretty good shape. Historically, stocks have liked this type of environment.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.