This week’s featured indicator uses the Reuters-CRB Continuous Commodity Index (CCI) to measure inflationary pressures and how that affects stock prices.

The CCI represents the average price of 17 commodities. It includes many of the major commodities we are familiar with, such as corn, soybeans, wheat, cattle, gold, copper, oil, and natural gas. Since these commodities tend to be a leading indicator of changes in consumer price inflation, the CCI makes for a useful gauge of looming inflationary pressures.

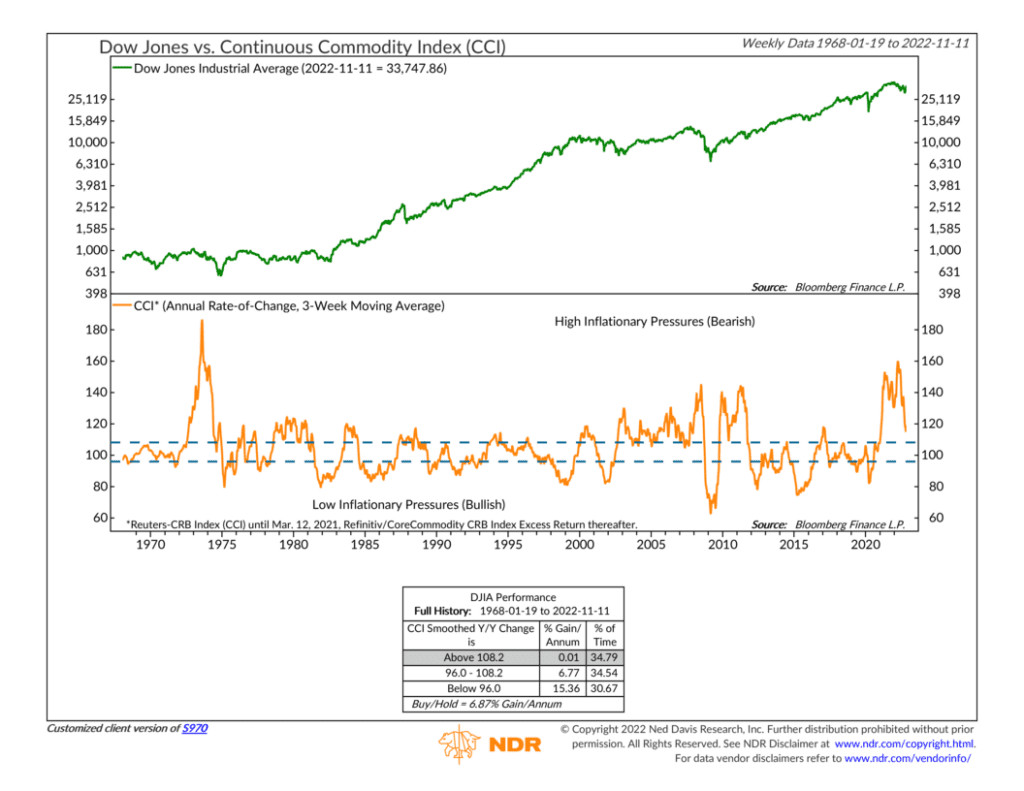

As a stock market indicator, the CCI is best used by averaging its annual rate of change by three weeks. This smoothed rate of change, as we call it, is shown as the orange line on the bottom clip of the chart above. Historically, when the smoothed rate of change exceeds 8.2% (108.2 on the chart), inflationary pressures are high, and the indicator enters the “high inflationary pressures” zone in which the stock market tends to perform poorly. However, when the smoothed rate of change drops to -4% (96 on the chart) or below, inflationary pressures are low, and the market tends to perform well.

As the chart reveals, the indicator has been in the high inflationary pressures zone for nearly two years now. The indicator anticipated the strong surge in consumer price inflation that began last year and continued well into this year—which has weighed heavily on the stock market this year.

The good news, however, is that the indicator peaked in April and is rapidly falling. To be sure, it’s still in the bearish upper zone, a sign that inflation pressures are still heavy. But at least the trend is moving in the right direction. If the indicator can fall into the neutral or even bullish lower zone, that would be a sign that inflationary pressures are easing significantly, and that would be a bullish condition for stock prices.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.