Confidence is key when it comes to investing. However, like a skier who has leaned too far out over her skis, confidence can backfire when it becomes excessive. When everyone is overly optimistic at the same time, trades become crowded, and returns tend to diminish.

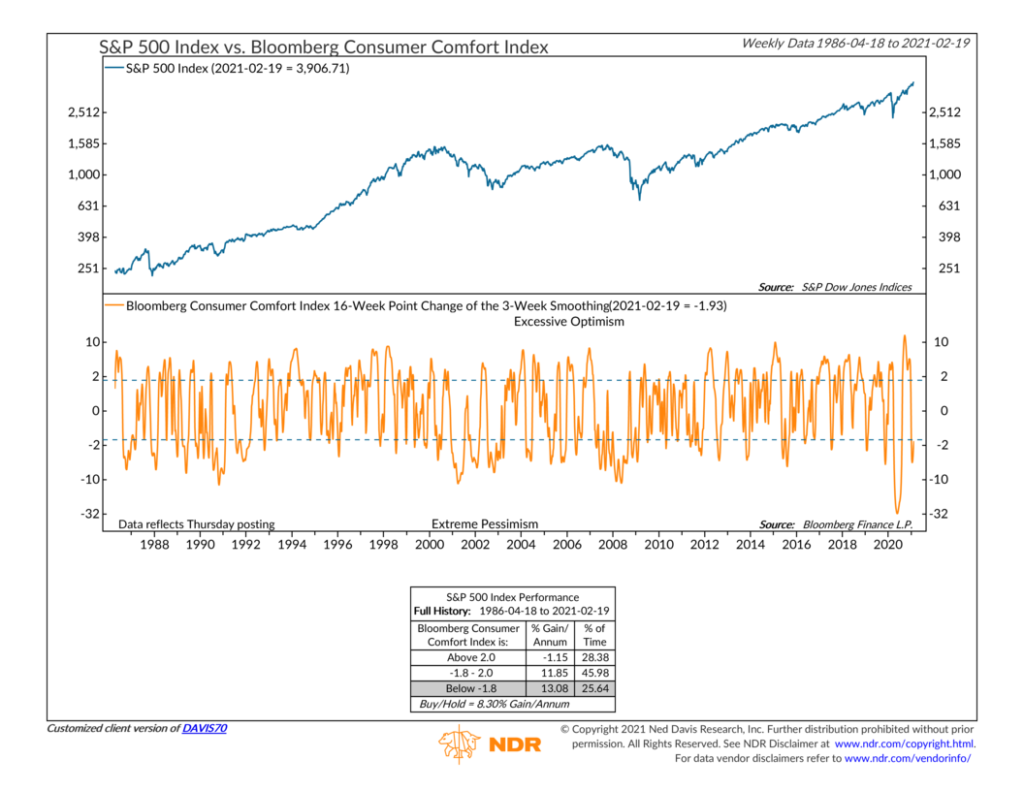

To see this in action, we present this week’s featured indicator in the chart above. The indicator uses the Bloomberg Consumer Comfort Index to measure confidence. To do this, it surveys 1,000 consumers across the country and asks them their opinion about three key areas: the national economy, their finances, and their willingness to spend money. The orange line in the bottom clip measures the change in these responses over approximately 16 weeks. A rising line indicates increasing confidence among consumers, and a declining line means confidence is falling.

Over the past 35 years, the data reveals that when this measure of confidence has reached an extreme level of optimism (above the upper dotted line), stock market returns have been abysmal, declining at an average rate of 1.15% per year. But when confidence is entirely shot (below the lower dotted line), stock returns have done well, returning about 13% per year, on average.

This is another example of using crowd psychology to our advantage. We don’t like to fight the trend, but we’re also wary of the crowd at extremes. Confidence is great until it’s not.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.