Now that inflation is on the decline, investors are increasingly focusing on stock market earnings. So for this week’s indicator, we will look at both inflation and corporate earnings in the form of the real earnings yield.

What is the real earnings yield? Well, the earnings yield is corporate earnings divided by price. So the real (inflation-adjusted) earnings yield is simply the earnings yield less the inflation rate.

Although the annual inflation rate has declined to about 5%, it’s still relatively high, which means that the current real earnings yield remains negative.

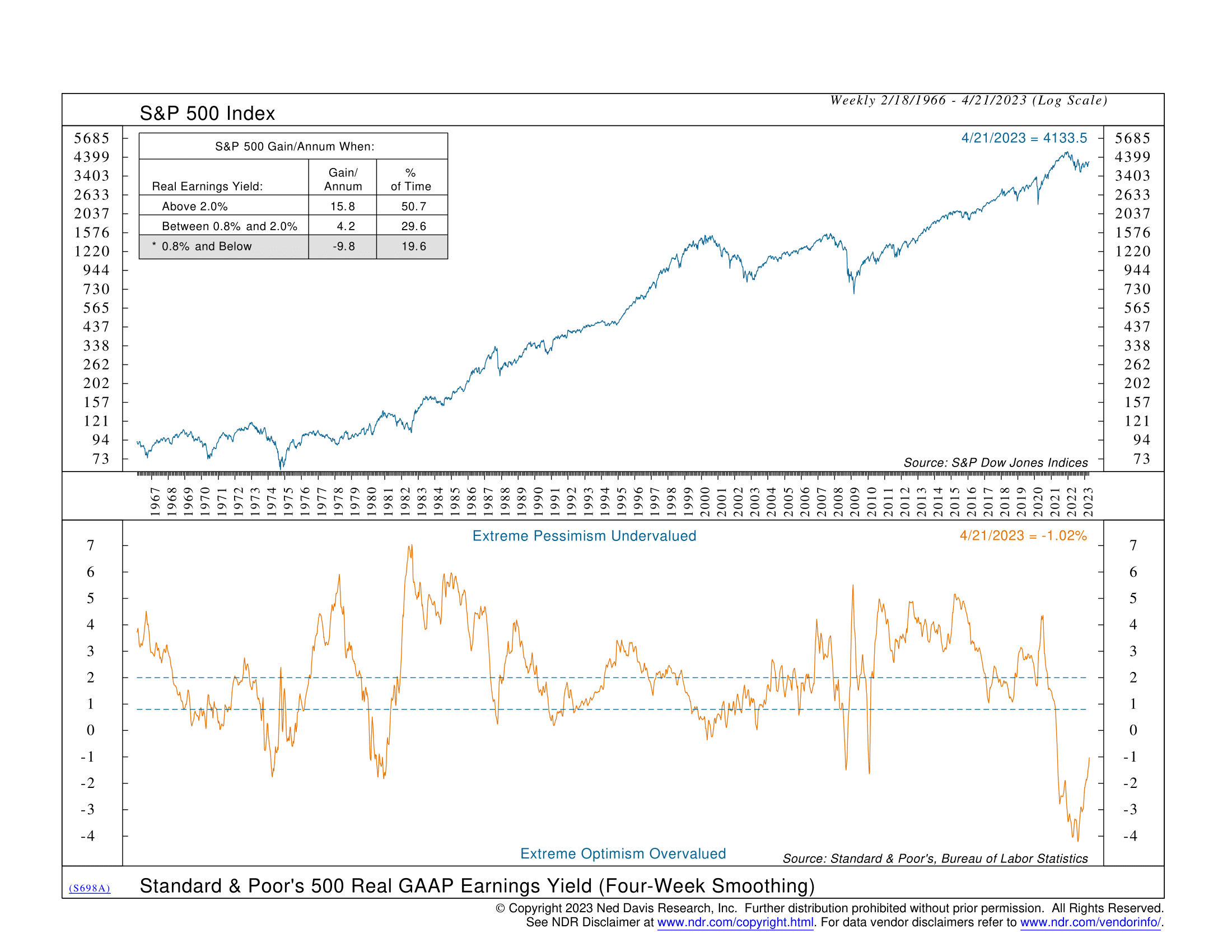

This is a rare occurrence, and the implication for stock market returns is not great. Historically, the S&P 500 stock index has tended to perform the worst when the real earnings yield is negative.

However, on average, the stock market has performed better following a high real earnings yield. In fact, the stock market has performed the best following a real earnings yield greater than 2%.

For that to happen in the near future, inflation will need to continue to fall while earnings at least hold steady. According to the indicator, the real earnings yield is currently -1%. If inflation falls to the Fed’s 2% target, that will get the real earnings yield to 2%—but only if earnings hold.

The bottom line? The most bullish case for the stock market centers around falling inflation and steady corporate earnings—resulting in a positive real earnings yield. Historically, the stock market can generate moderately positive returns with a real earnings yield greater than zero but below 2%. But the most bullish environment would be one in which the real earnings yield climbs above 2%.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.