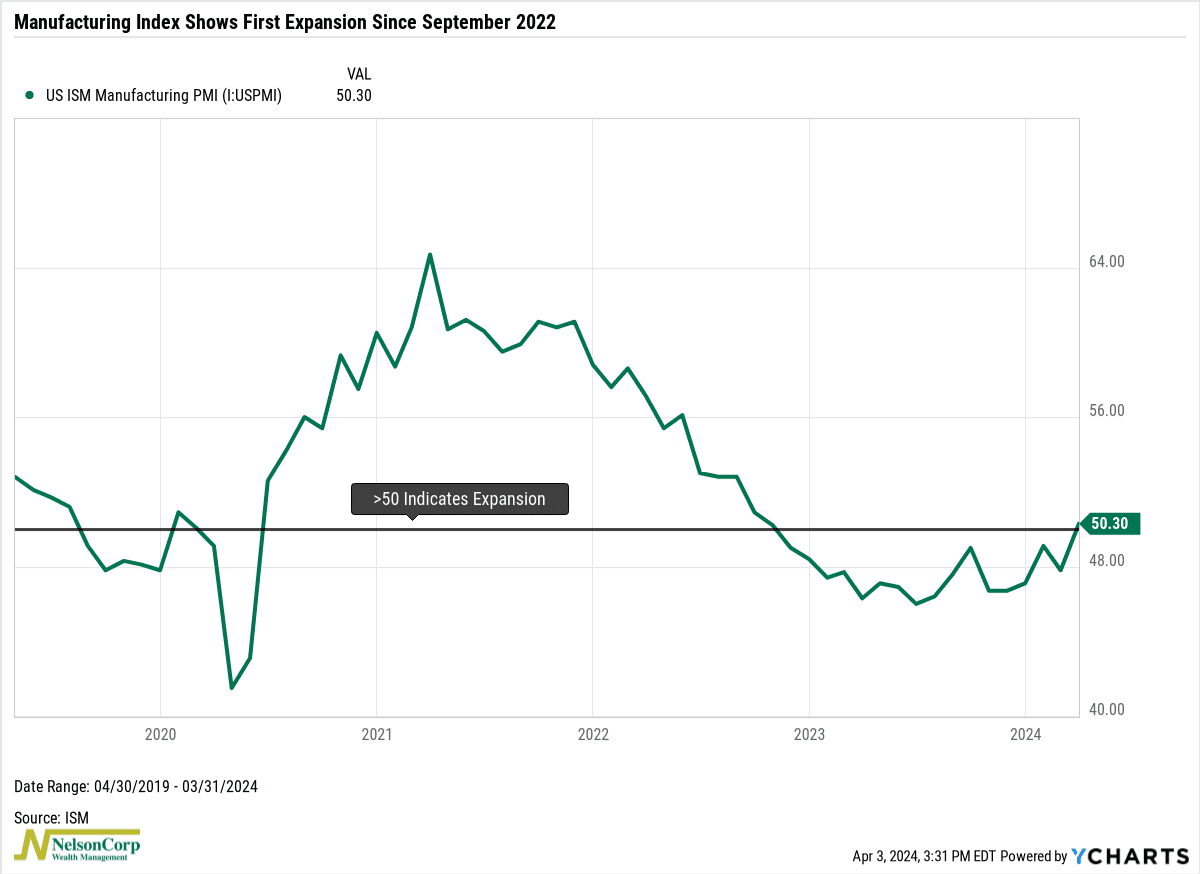

We got some good news regarding the manufacturing sector this week. The ISM Manufacturing PMI (Purchasing Managers’ Index) rose to 50.3 in March, up from 47.8 the previous month. This is a big deal because any number above 50 means the economy’s manufacturing sector is expanding, which is fantastic news considering it had been shrinking for 16 consecutive months prior to last month.

This positive trend is good for the overall economy. However, its impact on the stock market is a bit more complicated.

From an earnings standpoint, it’s good news. Historically, when the ISM Manufacturing Index is expanding, S&P 500 earnings per share have typically grown by around 12% on average.

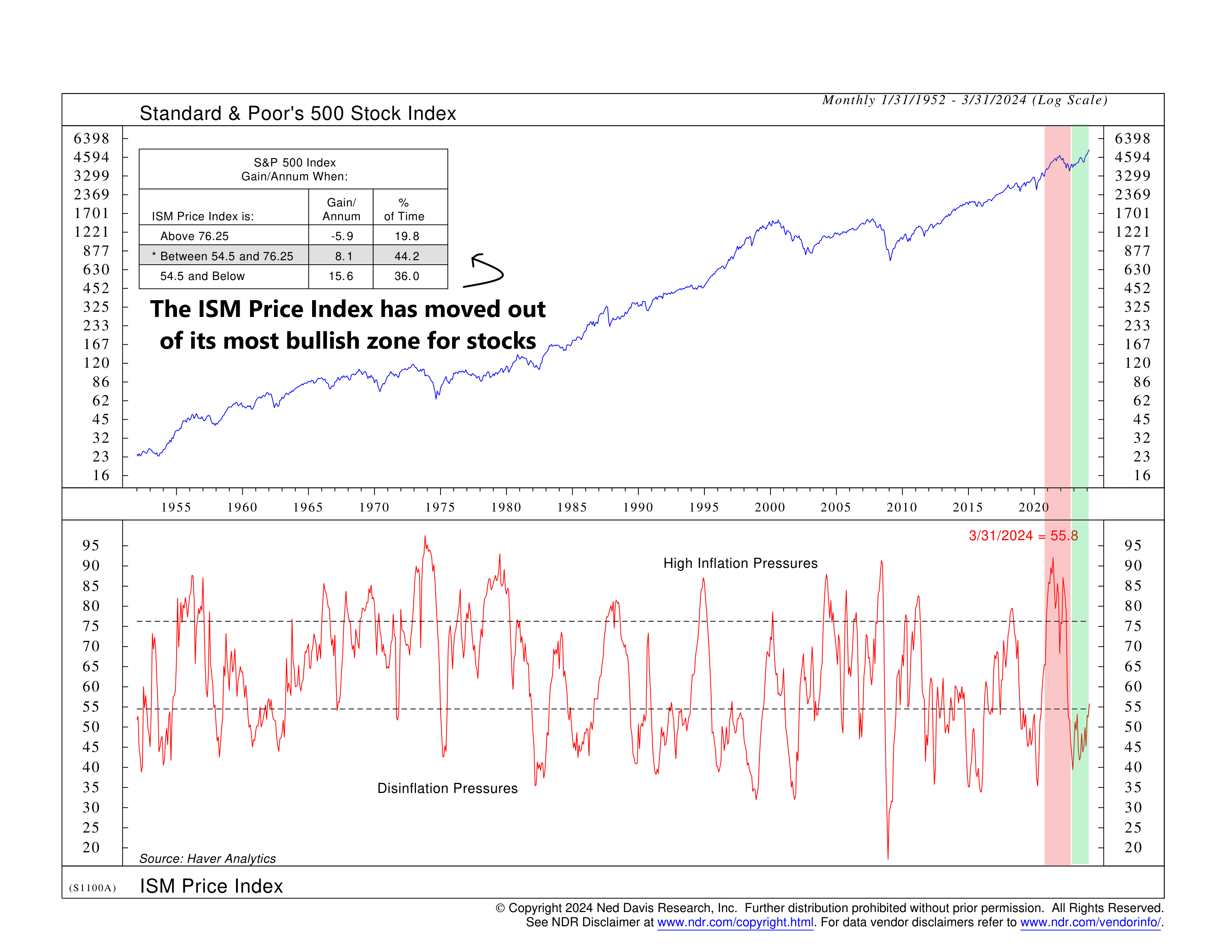

The downside, however, has to do with inflation. The ISM Manufacturing PMI increased partly because the ISM Price Index also increased. The ISM Price Index—a subcomponent of the ISM Manufacturing PMI—measures the changes in prices paid by manufacturing companies for materials and services used in production. When it rises, it usually indicates inflationary pressures are building up.

Back in late 2021 and 2022, these inflationary pressures negatively impacted the stock market, pushing prices down. However, by 2023, these pressures had eased, and the ISM Price Index entered its most bullish zone for stock prices.

After last month’s increase, however, the ISM Price Index has moved out of its bullish zone and is technically in neutral territory. While stocks have historically performed well in this zone, gaining about 8% per year on average, it could potentially influence the Federal Reserve’s thinking on interest rates and whether inflation has eased enough to start cutting them later this year.

So, the bottom line is that while the manufacturing sector’s recent growth is great news for the economy and stock market earnings, the slight uptick in inflationary pressures could also introduce some uncertainty into monetary policy and the stock market later this year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S