Sometimes the stock market is quiet, and there isn’t a whole lot of price movement in either direction.

But other times, the market gets excited and surges powerfully in a particular direction. We call this sharp shift in sentiment a “thrust.”

One of our favorite types of thrust indicators is a “breadth thrust” indicator, which looks at the relationship between advancing and declining stocks in the stock market.

Every day, a list of the number of stocks that closed higher (advanced) and lower (declined) is published. The difference between the two is called daily breadth.

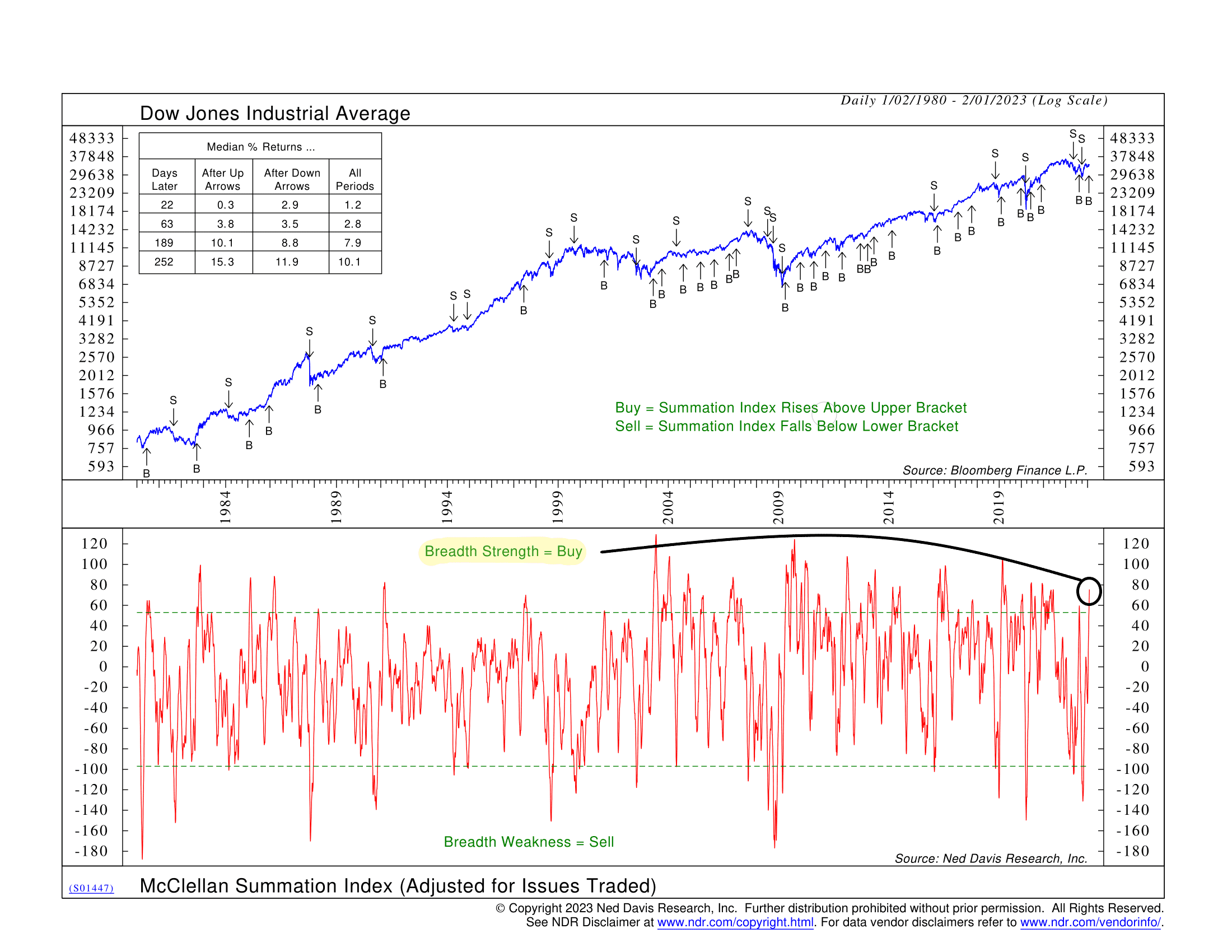

The McClellan Summation Index, shown above, takes this daily breadth number and adjusts it by subtracting a 39-day exponential moving average from a 19-day exponential moving average. When it’s high (above the upper bracket), it means money is flowing into the market, and momentum is surging upwards. Historically, this has been a good time to buy. Lower readings, however, equate to money leaving the market and weak momentum.

The performance box in the top left corner shows how the Dow Jones Industrial Average (a proxy for the stock market) has performed after buy and sell signals. The main takeaway is that buy signals tend to be more productive than sell signals. About three months after a buy signal, the Dow has outperformed a buy-and-hold strategy by about 1%, on average. A year later, the performance gap widens to about 5%. As for the sell signals, they don’t produce much in the way of outperformance. (However, this doesn’t mean the sell signals are worthless; they can still add value when combined with other thrust indicators in an overall risk model).

Because this is a cumulative measure of daily breadth, the McClellan Summation Index is useful for analyzing the stock market’s broader, longer-term price trends—as opposed to short-term changes. Indeed, we’ve found that buy signals tend to occur in the early stages of major, long-term market moves.

We recently received a positive breadth thrust signal from this indicator. This is worth paying attention to as it is a sign that the market has built up a lot of momentum in recent weeks. According to this indicator, further price strength could accumulate over the course of the next three months to even a year from now.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.