The stock market is rising, and valuations are, too.

But what exactly do we mean by valuations? Well, it’s all about a metric called the price-to-earnings ratio (P/E ratio). This ratio measures the price of a stock market index, like the S&P 500 Index, divided by the operating earnings per share of S&P 500 companies. Essentially, it is a multiple that tells us how much investors are willing to pay for stocks relative to the earnings they generate.

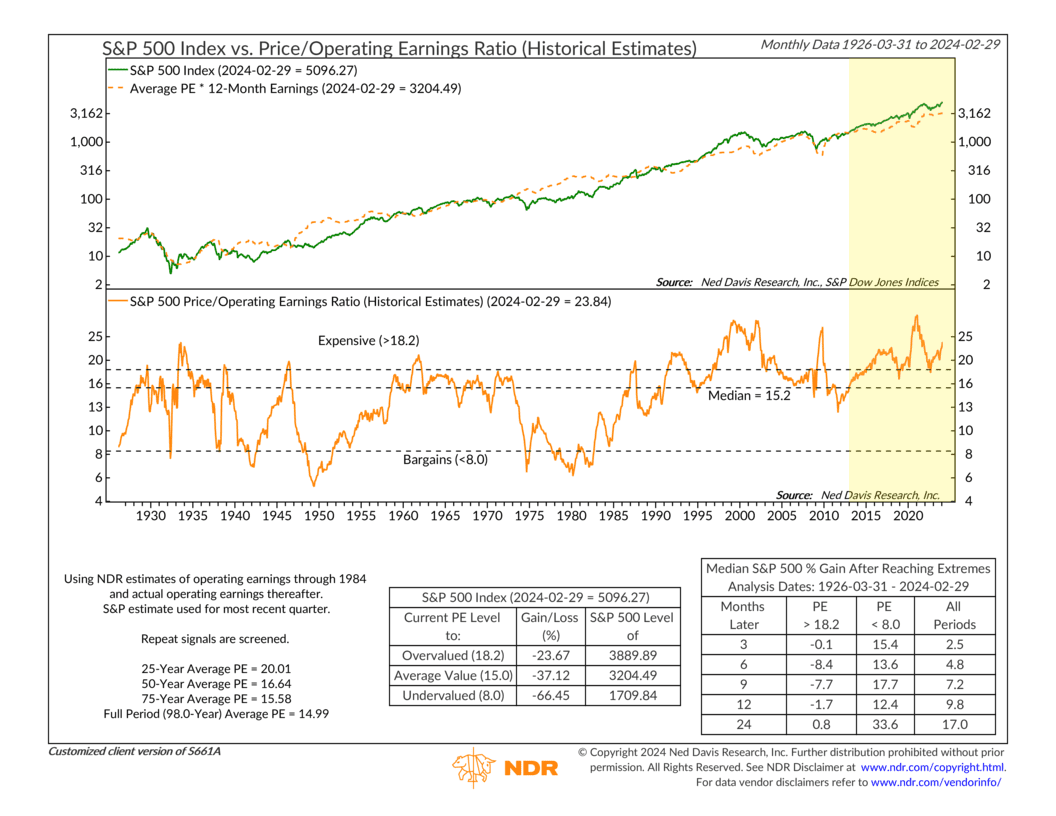

Now, take a look at the orange line on the bottom half of the chart. It shows the S&P 500 price/operating earnings ratio since 1926. Historically, the average has been about 15, meaning investors have typically been willing to pay 15 times operating earnings. But right now, that number is nearly 24, the highest since the 2000 tech bubble (excluding the spikes after the Great Financial Crisis and the pandemic caused by falling earnings).

What does this mean for investors? In simple terms, it means stocks are expensive. To get back to the long-run average multiple of 15, the S&P 500 Index would need to fall more than 35% from current levels.

However, it’s worth noting that stocks have been trading at expensive levels for the past 11 years (highlighted in the chart above). Despite some major corrections along the way, stocks have continued to climb, and earnings have kept pace. This suggests that investors are extremely confident that S&P 500 companies will deliver strong operating earnings in the future.

This idea is backed up by the fact that the price movement section of the market and the economic environment remain strong.

However, at the end of the day, fundamentals and valuations still matter. The fact that investors are extremely enthusiastic about stocks and pushing valuations to historical highs means that if we see a breakdown in the other market components, it could lead to a challenging environment for stocks as investors reevaluate their willingness to pay such high multiples.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S