It’s an election year, and naturally, investors are wondering how it might impact their investments. Perhaps surprisingly, we find that the president’s influence on markets isn’t as significant as many believe. However, our data does suggest that sentiment toward the president does tend to align with stock market performance—although not in the way you might expect.

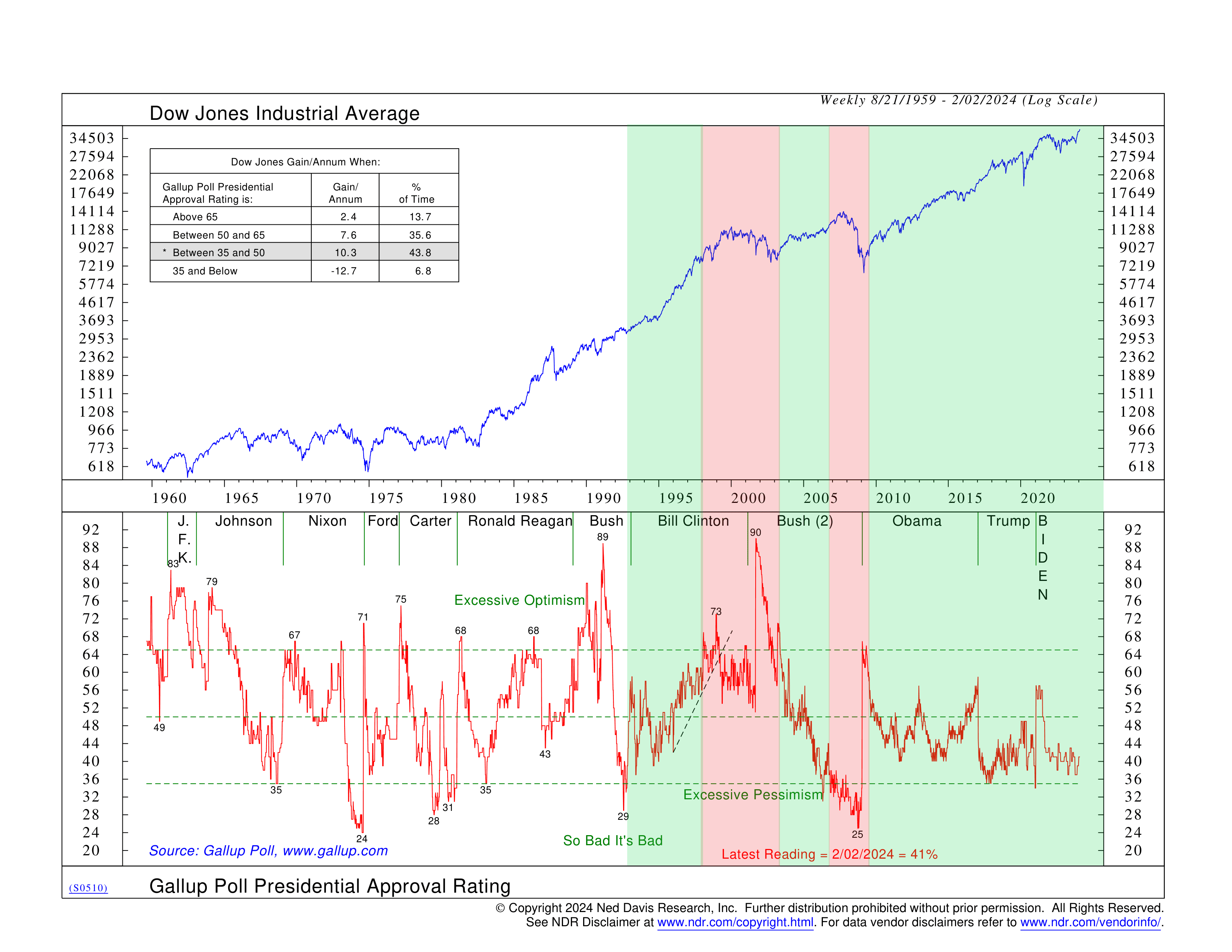

To gauge this, we use an indicator that features the Gallup Poll Presidential Approval rating (red line) versus the Dow Jones Industrial Average (blue line), going back to Eisenhower. We break it down into four modes: above 65 indicates excessive optimism towards the president, between 50 and 65 is moderately optimistic, between 35 and 50 is moderately pessimistic, and below 35 is excessively pessimistic.

What’s intriguing is that when people feel really good about the president, stock market returns tend to dip. But when sentiment is very low (below 35), returns also suffer. Surprisingly, moderate dissatisfaction with the president seems to be the sweet spot for stock market returns.

For instance, I’ve highlighted a few periods on the chart where presidential approval ratings were mostly moderate or moderately low. Contrary to expectations, the Dow performed remarkably well during these times. However, during periods of extreme sentiment—either very high or very low—the stock market generally underperformed.

The good news? Currently, the presidential approval rating sits around 40%. While not great, historically, this level has been good for the stock market. Unless we see a significant rise in presidential sentiment or a plunge into extremely low levels (the So Bad It’s Bad zone), history suggests that the bull market could continue.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks.