This week’s indicator is all about pricing power. When a company has pricing power, it can increase its prices and still maintain demand for its products. Whether or not a company can do this depends on various factors. But for many companies, labor is the biggest cost of doing business, so the cost of labor is a significant determinant of whether a company ultimately has pricing power.

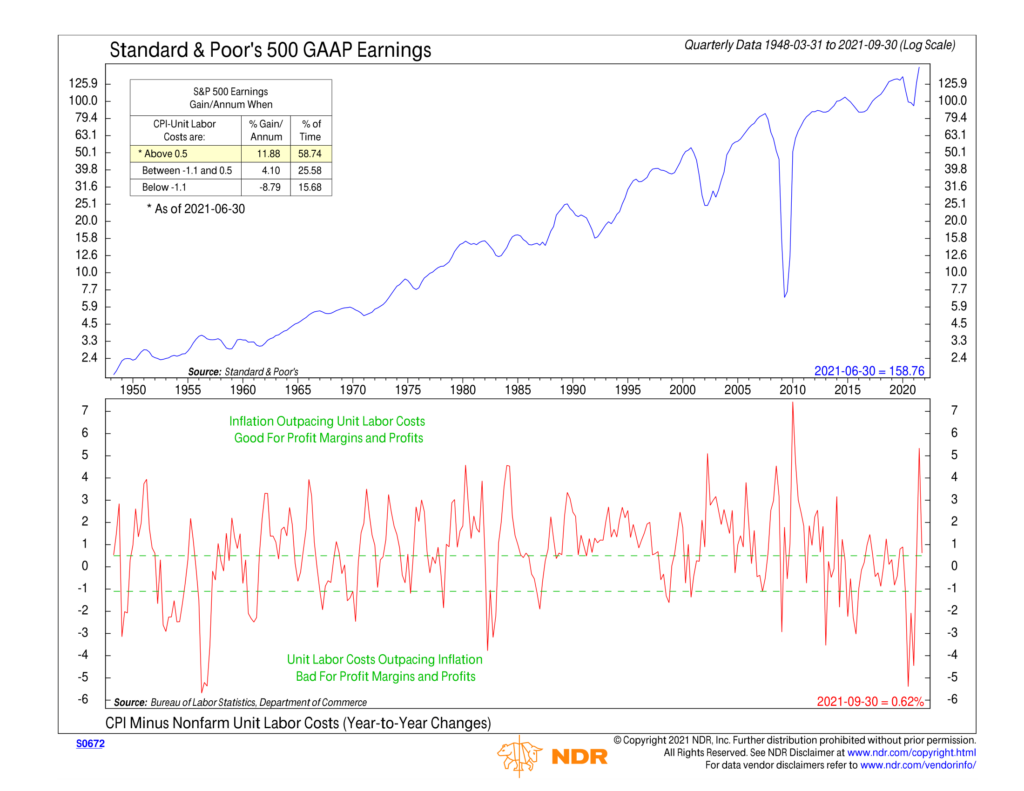

Here’s how the indicator works. The top half of the chart shows the historical 1-year trailing earnings per share of the S&P 500 index. This is the “bottom line” of the major companies in the United States—aka how profitable they are. And in the bottom half of the chart, we show the difference between the Consumer Price Index (CPI) and Non-Farm Unit Labor Costs (year-to-year changes). When this line is rising, inflation is outpacing labor costs, which is good for profit margins. However, if the line is falling, labor costs are rising faster than inflation, which is bad for profit margins.

The takeaway from this indicator is that when prices have historically grown faster than wages, profit margins have tended to increase, and S&P 500 earnings per share have grown at an above-average rate. But when wages have risen more quickly than prices, profit margins have come under pressure, and S&P 500 earnings have tended to come down. Earnings drive stock prices, so this is a powerful dynamic to be aware of.

Looking at this chart over the past year or so, we can see a considerable spike and then reversal in the indicator. This means that after of period of relatively high inflation, we are starting to see labor costs gain ground against inflation, which, if the trend continues, could signal that companies are no longer able to pass along higher input costs to customers as they had previously. This could hurt profit margins going forward.

Indeed, some companies have recently announced that they are taking the “noble” route of absorbing some higher costs rather than pass them on to customers and risk losing them to rivals. This will be worth watching as it could have a large impact on earnings, which have been phenomenal this year but are likely to come down next year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.