A Recession, or a sustained slowdown in economic growth, is one of the worst things that can happen to the stock market. The problem? Recessions are hard to predict. Hard, but not impossible. We can still get close by assigning a probability to a recession using a statistical model, which is exactly what this week’s featured indicator does.

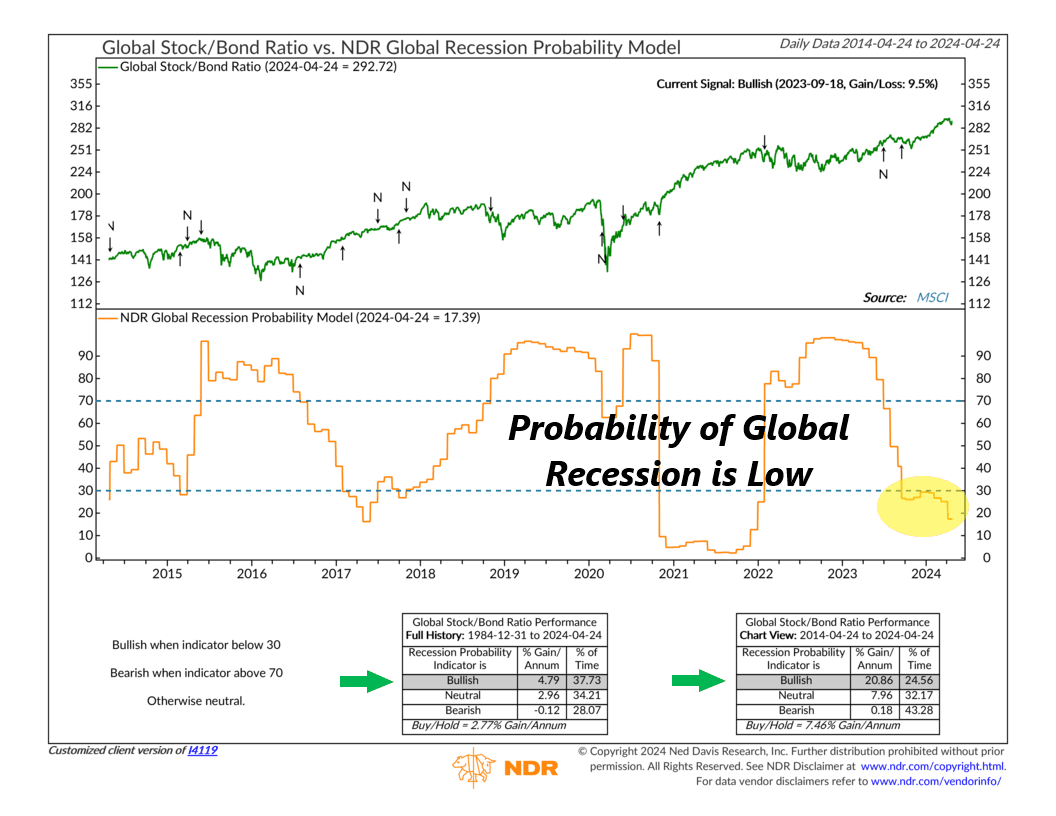

Here’s how it works. On the top clip of the chart above, we show the global stock/bond ratio in green. When it’s rising, it means stocks are outperforming bonds—and vice versa. On the bottom clip, we present the NDR Global Recession Probability Model (orange line), a proprietary model developed by Ned Davis Research that uses statistical analysis to measure the probability of a global recession at any given point in time.

When the model’s reading is below 30%, the chance of a global recession is low. As the performance box shows, the stock/bond ratio has increased at a 4.76% annualized rate when this has been the case historically, meaning stocks have done better relative to bonds. But, when the model gets above 70%, the chance of a global slowdown increases significantly. The stock/bond ratio has decreased when this happens, meaning bonds have meaningfully outperformed stocks.

What’s the model saying now? Well, the good news is that after a heightened chance of a global recession sent both stocks and bonds down in 2022—resulting in a flat stock/bond ratio—the chance of a global recession has dropped to under 18% this year. Since the bullish trigger back in September 2023, global stocks have outperformed bonds by more thean 9%. As long as the model stays relatively low, we think this could be a bullish tailwind for global stocks going forward.

The bottom line? Predicting recessions is a difficult task—and it’s certainly not a precise science. It’s like trying to guess the weather—it’s not always spot on. But having tools like this model can help investors make smarter decisions and maybe even give them a little edge in managing risks.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.