For this week’s indicator, we’re going to look at a technical concept called relative strength.

What is relative strength? In simple terms, it measures how well one investment or asset is doing compared to another. It’s typically calculated by dividing the price of one asset by that of another to get a relative strength ratio.

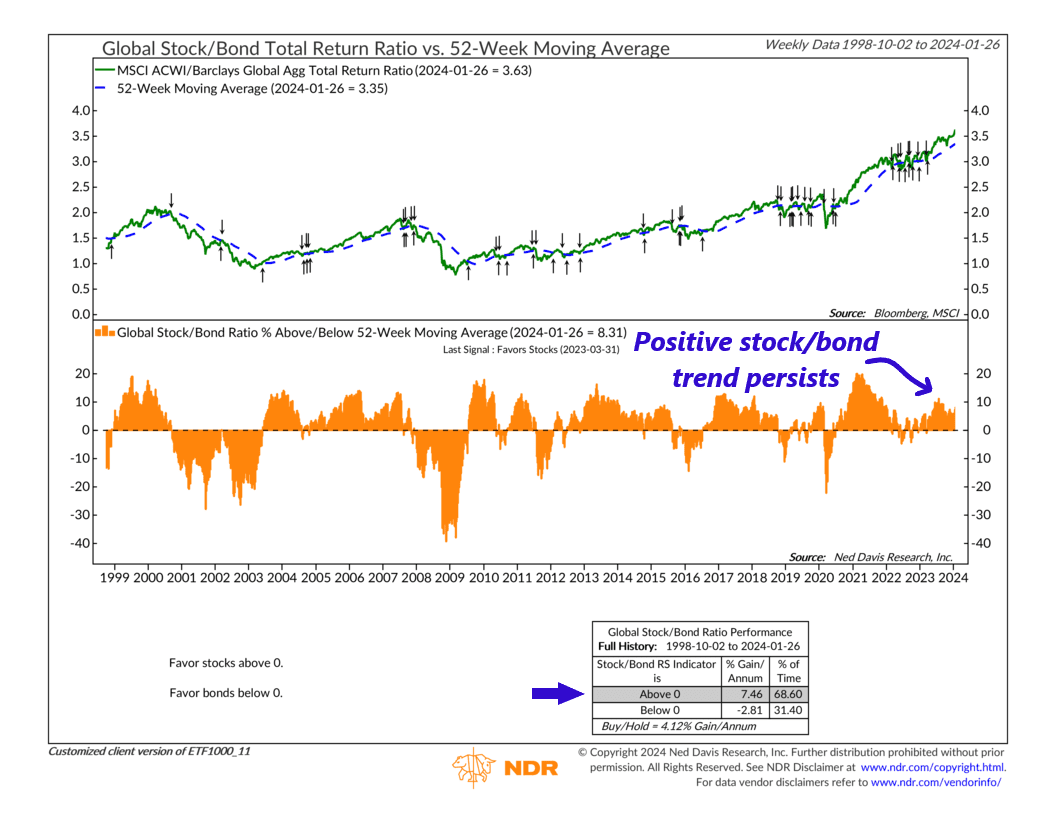

In our case, we’re looking at the relative strength of global stocks versus global bonds, represented by the ratio of the MSCI All-Country World Index (stocks) to the Bloomberg Barclays Global Agg Index (bonds). This is the green line on the top clip of the chart above. When it’s rising, it means stocks are outperforming bonds, but when it’s falling, it means bonds are outperforming stocks.

But here’s where it gets interesting. It’s not enough to just know whether the relative strength line is rising or falling; we need to measure its trend somehow to develop a tradeable indicator. That’s where the 52-week (1-year) moving average comes in to play, shown as the blue-dashed line on the chart.

When the stock/bond relative strength line is above its 52-week average, it’s a sign of an upward trend in the ratio, meaning stocks are trending higher relative to bonds. If it’s below the average, it’s a sign of a downward trend in the ratio, meaning bonds are outperforming. The indicator shows the distance between the relative strength line and its moving average as the orange bars on the bottom clip.

Historically, when the distance is greater than zero—favoring stocks—the stock/bond ratio has had a positive return, meaning stocks are trending better than bonds. But when the distance is below zero—favoring bonds—the stock/bond ratio has had a negative return, meaning bonds are the better-performing asset.

What’s the indicator saying now? Well, for about a year now, the stock/bond relative strength ratio has been above its 52-week average. It dropped to less than 2% at the end of October—but has since recovered and is now more than 8% above its long-term trend.

In other words, global stocks continue to be favored over global bonds based on relative strength trends, supporting the argument to be more overweight stocks at this time.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The MSCI ACWI captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets countries. With 2,935 constituents, the index covers approximately 85% of the global investable equity opportunity set.

The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment-grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from both developed and emerging markets issuers.