The equity risk premium is something that has been talked a lot about recently in the financial world, mainly because it dropped to its lowest level in 14 years last month. This is concerning because it has the potential to pose a significant challenge to the stock market.

Why? Because the equity risk premium is the excess return investors are compensated with for their willingness to accept the higher risk of the stock market. In other words, it’s the extra return you get for holding stocks over safer investments like bonds. Typically, it’s calculated by subtracting the expected return on safe bonds from the expected return on stocks. If it’s falling, it means the stock market is paying you less of a premium for putting your money on the stock market roller coaster versus the sure thing of government bonds.

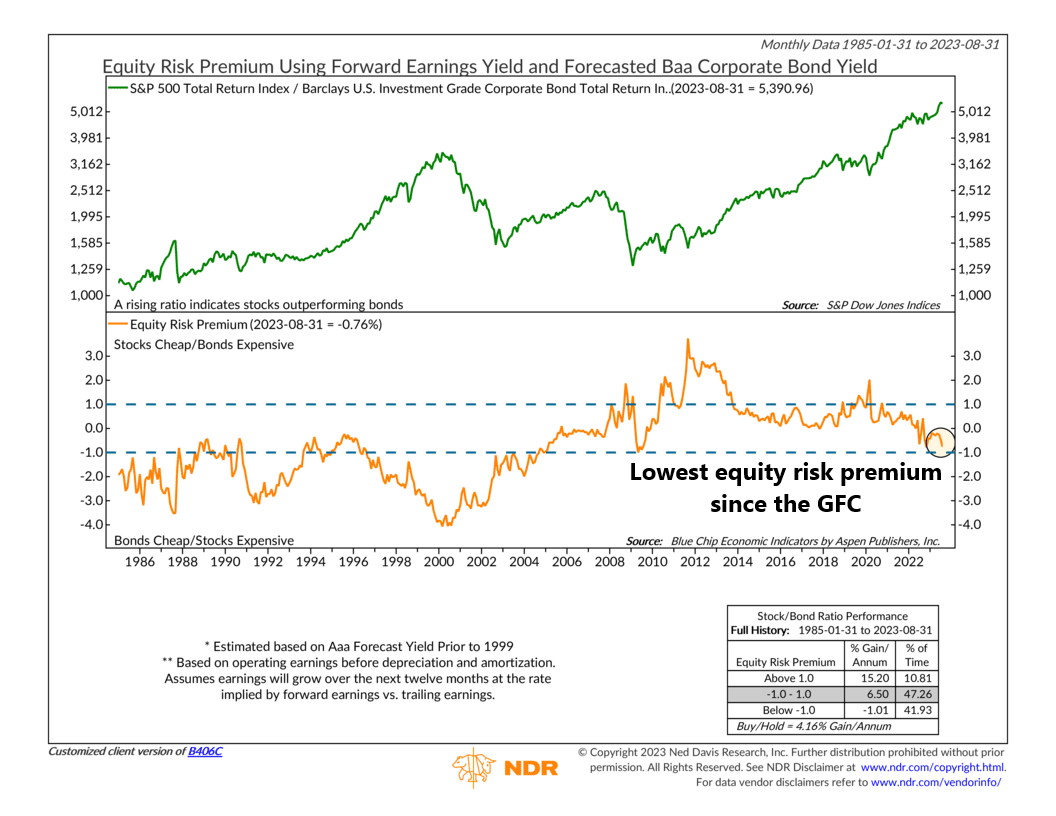

The equity risk premium, shown as the orange line on the indicator above, is actually negative at the moment—about -0.76%, to be exact. As you can see, this is the lowest since 2009. It’s also at the bottom of the “neutral zone” on the chart, which is concerning because a fall below the lower bracket would mean stocks could face some serious competition from bonds.

The bottom line? The low equity risk premium is likely a reason to soften expectations for stock market gains in the coming year. Of course, that also assumes interest rates on bonds stay high. If rates fall, stocks could gain some support, and the equity risk premium would rise again. But for now, this indicator suggests that a neutral stance towards stocks is wise.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.