The standard economic definition of inflation is a sustained increase in the general price level in an economy. It’s worrisome because inflation can lead to an increase in the cost of living. Why? Because if the prices for goods and services in an economy are increasing but wages aren’t keeping up, it can lead to a decline in the purchasing power of your money. In other words, your dollars won’t buy as much stuff as they used to.

For consumers, it’s obvious why rising inflation is something to worry about. But for investors, the worry is more about how inflation will affect stock prices—which brings us to this week’s featured indicator.

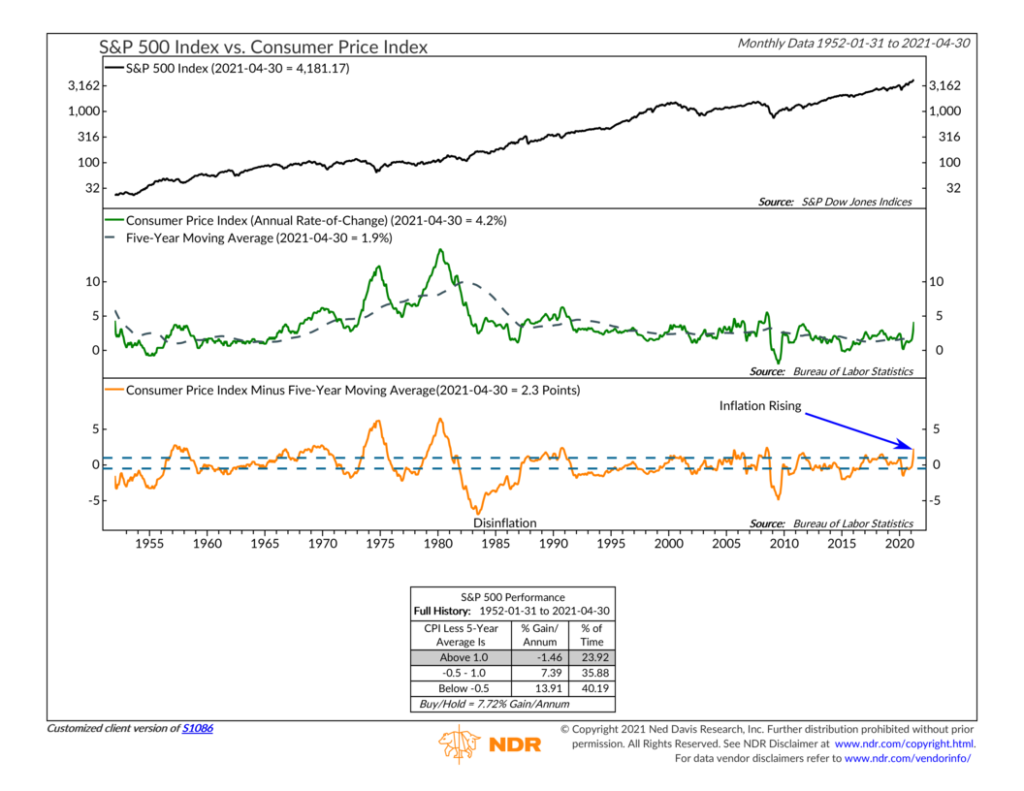

We call it the Inflation Indicator because it analyzes how changes in the Consumer Price Index (CPI) affects stock prices. The CPI is a commonly followed metric that measures the cost of everyday items like groceries, clothes, and activities — and is closely linked to inflation.

The chart below plots the S&P 500 stock index in the top clip and the year-to-year change in the CPI relative to its five-year moving average in the middle clip. The bottom clip shows the same thing but instead subtracts the five-year moving average from the year-to-year change in the CPI. This way, we can see if the rate of inflation is coming in faster or slower relative to its most recent five-year history.

For example, the CPI number just announced this week showed that prices increased 4.2% in April compared to a year ago. If we subtract out the five-year average of 1.9%, we get 2.3%, which is where the orange line in the bottom clip of the chart currently stands. This was a large enough increase to push it above the upper dashed line, a sign that inflation is really picking up.

The data, which goes back to the 1950s, suggests this is not good for stock prices. When the change in the CPI less its five-year average rises above the upper dashed line, inflation is accelerating, and stocks have done poorly as a result. However, when the measure is below the lower dashed line, the inflation rate is decreasing, and stocks have performed well above average.

Stocks have reacted this way in the past not necessarily because inflation in and of itself is bad for stocks (although it can be in some cases) but more because of the effect of rising inflation on interest rates. Suppose America’s central bank, the Federal Reserve, believes that inflation is getting out of hand. In that case, it will likely throw water on the overheated economy by raising interest rates, which, for various reasons, can hurt stock prices.

To be sure, the Federal Reserve has made it clear that it is willing to accept higher than average inflation for a while to make up for all the years of below-average inflation. And they also have stated that they believe the current run of inflation is temporary. So maybe the threat of higher interest rates won’t weigh down stocks this go around. That’s certainly plausible. But in general, based on the historical record, a rising CPI tends to hurt stock prices, whereas a steady or falling CPI is usually beneficial.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.