This week’s indicator is based on the idea that the more stocks participating in a rally, the better. To find this level of participation or breadth, we use a technical tool called a 200-day moving average.

When applied to the price of a stock, for example, the 200-day moving average is the stock’s average price over the previous 200 days. The reason it’s called a moving average is because each day, a new 200-day average is calculated by dropping off the oldest price and adding the most recent price. Therefore, it illustrates the 200-day average price of the stock over time as a series of averages. In doing this, we can compare a stock’s current price to its 200-day moving average and determine if the long-term trend of the stock’s return is generally rising or falling.

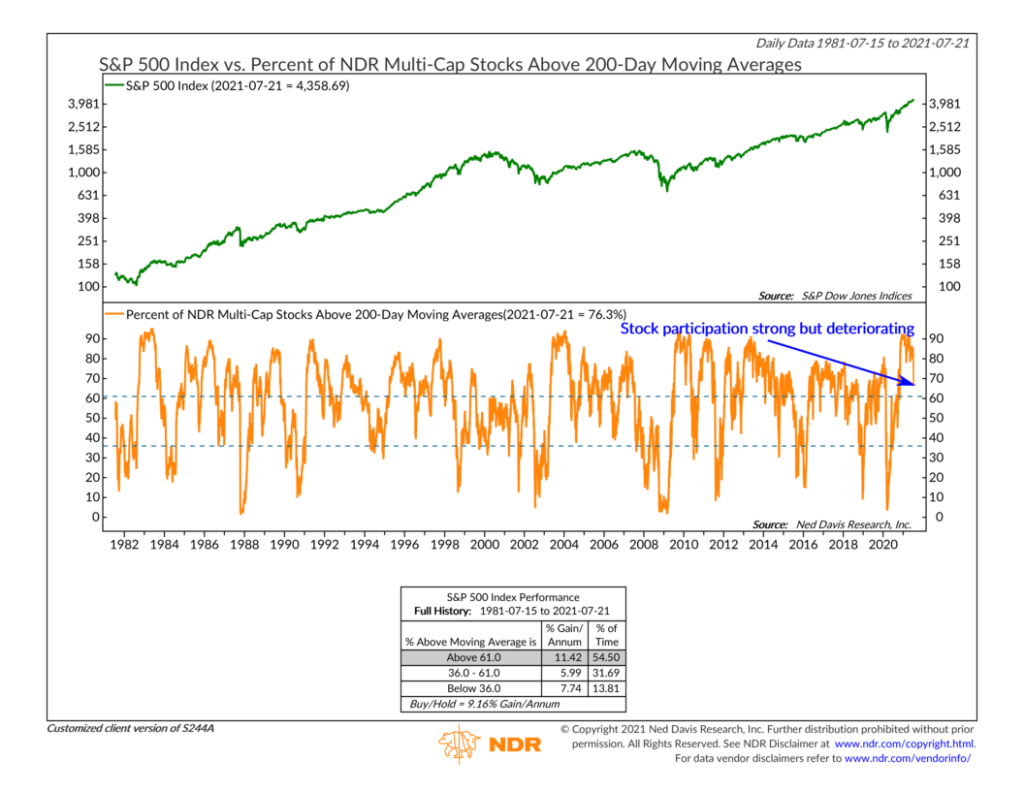

The indicator above applies a 200-day moving average to all the stocks in the U.S. stock market and then calculates the percentage of them trading above their respective 200-day moving averages. Historically, we’ve found that when at least 3 out of every 5 stocks (or about 60%) are trading above their 200-day moving average, the S&P 500 index has done exceptionally well—returning over 11% per year, on average. However, when less than 60% of stocks are trading above their 200-day moving average, the S&P 500’s returns have been below the average buy and hold return of about 9.15%.

Lately, if you look at the far end of the chart, you can see we’ve had a pretty sharp dip in the percentage of stocks participating in this year’s rally. At about 76%, this is still a very healthy level of long-term participation. However, suppose breadth continues to deteriorate at this rate. In that case, it could eventually leave the overall market vulnerable to lower returns—as that means only a few stocks are keeping things propped up.

The main takeaway, then, is that when it comes to stock market returns, the more the merrier!

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.