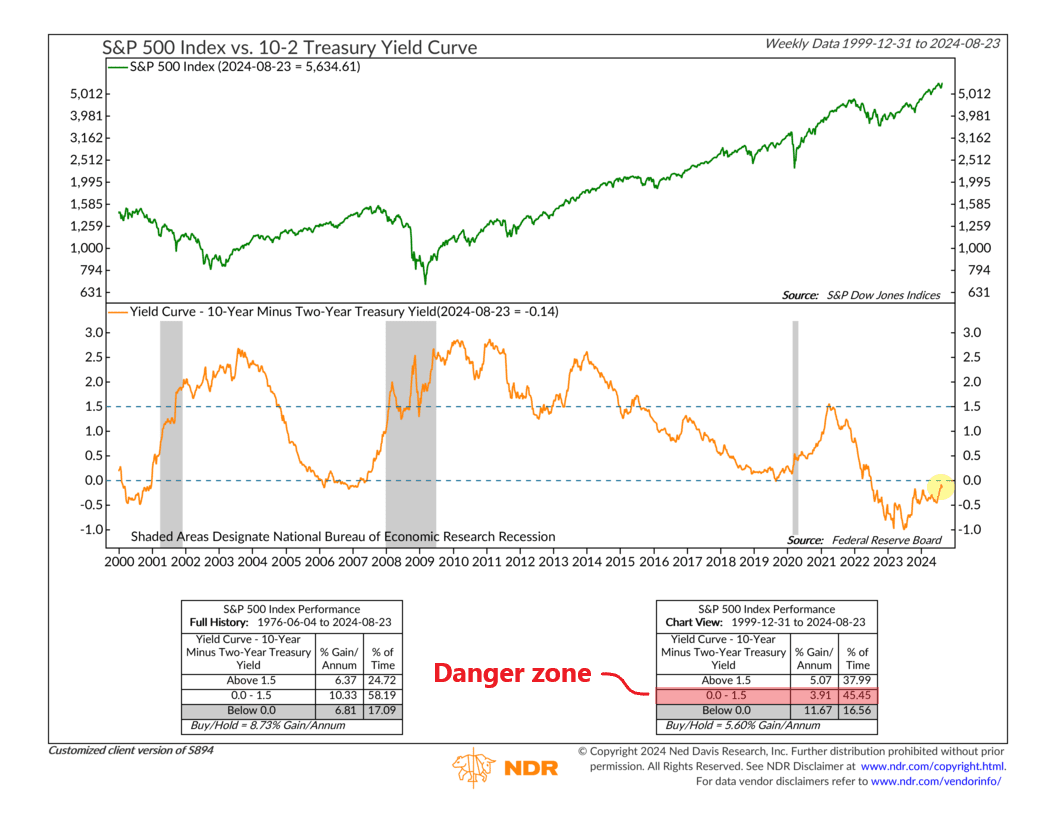

If you’ve kept your eye on financial markets the past few years, you’ve likely heard some buzz about the yield curve. It went negative over two years ago, meaning short-term rates (2-year Treasury rates) rose above long-term rates (10-year Treasury rates).

That’s unusual. Typically, long-term rates are above short-term rates, creating what is called an upward-sloping yield curve. But when it flips—like it did two years ago—it becomes “inverted.” This is concerning because it’s often a red flag for a potential recession.

Recently, however, the yield curve is back on everyone’s mind because it’s getting close to un-inverting or returning to a normal upward sloping curve.

So what? You’re probably thinking that’s a good thing, right?

Not so fast. As our featured indicator above shows, since 2000, these un-inversions have not been a sign of economic improvement. In fact, they’ve tended to occur prior to economic recessions.

In other words, for the past 24 years, the transition from an inverted to a normal yield curve often happens when the economy is already facing tough times.

Plus, to add insult to injury, the performance box on the lower right of the chart shows that the S&P 500 Index tends to perform the worst when the yield curve (10-year minus 2-year Treasury yield) is between 0% and 1.5%—which is where it’s currently headed.

Of course, as we like to say, this is only one indicator—one piece of the overall financial puzzle. It’s important to take a weight-of-the-evidence approach to these types of things, considering other economic signals and market conditions.

But I will note that all six yield curve indicators we incorporate into our models are currently in “danger” zones. Like this indicator, they all warn of a negative environment for stock returns. This collective caution suggests that the overall economic outlook is unlikely to become significantly more positive anytime soon.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.