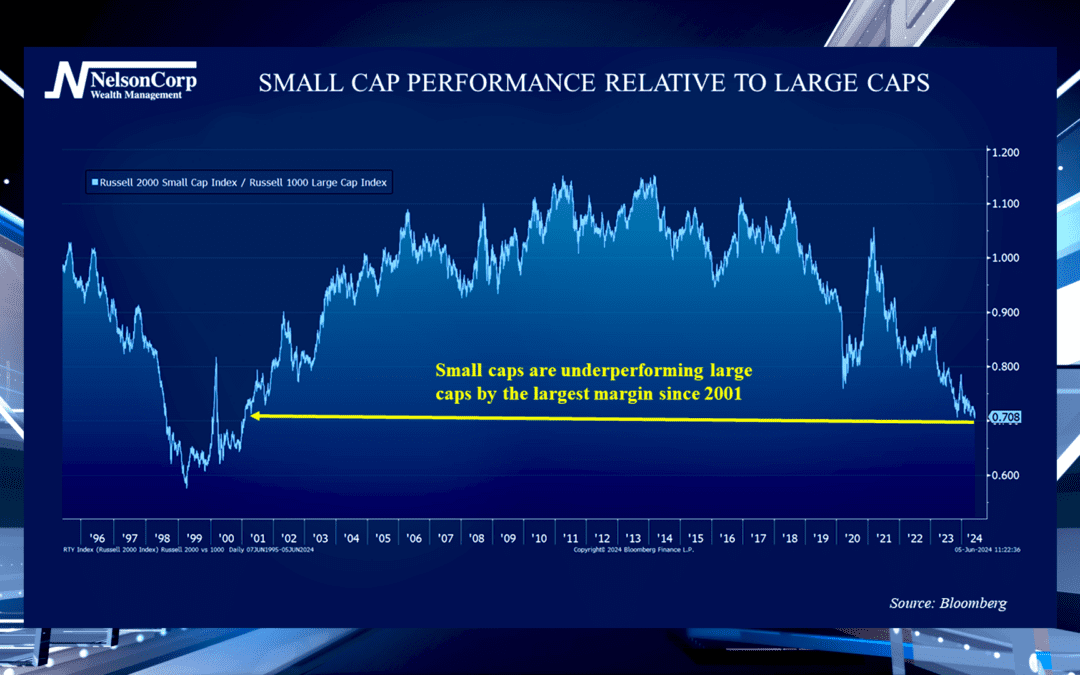

Small Caps Staying Small

Not all areas of the stock market are performing as well as the popular market averages right now. David Nelson joins us to discuss the areas that seem particularly weak and if he believes investors should avoid them for the time being.

The Glad Game

Pollyanna’s “Glad Game” brought her success in Eleanor Porter’s 1913 novel. But while beneficial in daily life, this optimistic philosophy poses risks in investing. Dive into our latest commentary to learn why excessive optimism can spell trouble for investors.

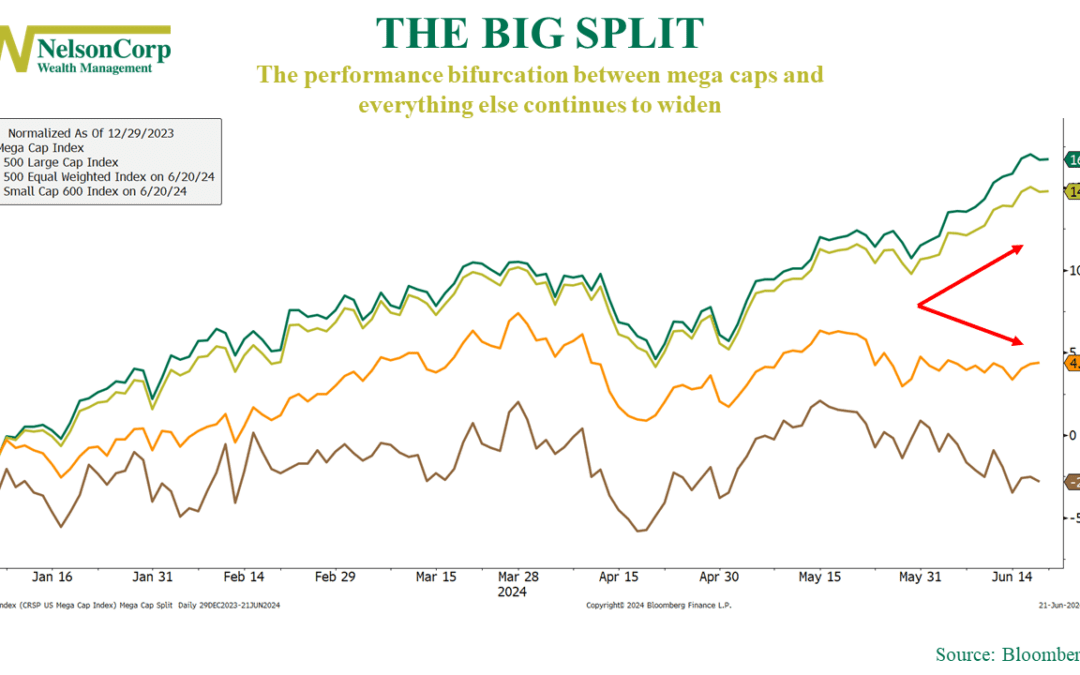

The Big Split

There’s a growing divide in the United States. No, I’m not talking about the Grand Canyon in Arizona. Or politics. But rather Wall Street, in the stock market, and it’s being driven by mega-cap stocks. This week’s featured chart highlights the performance of...

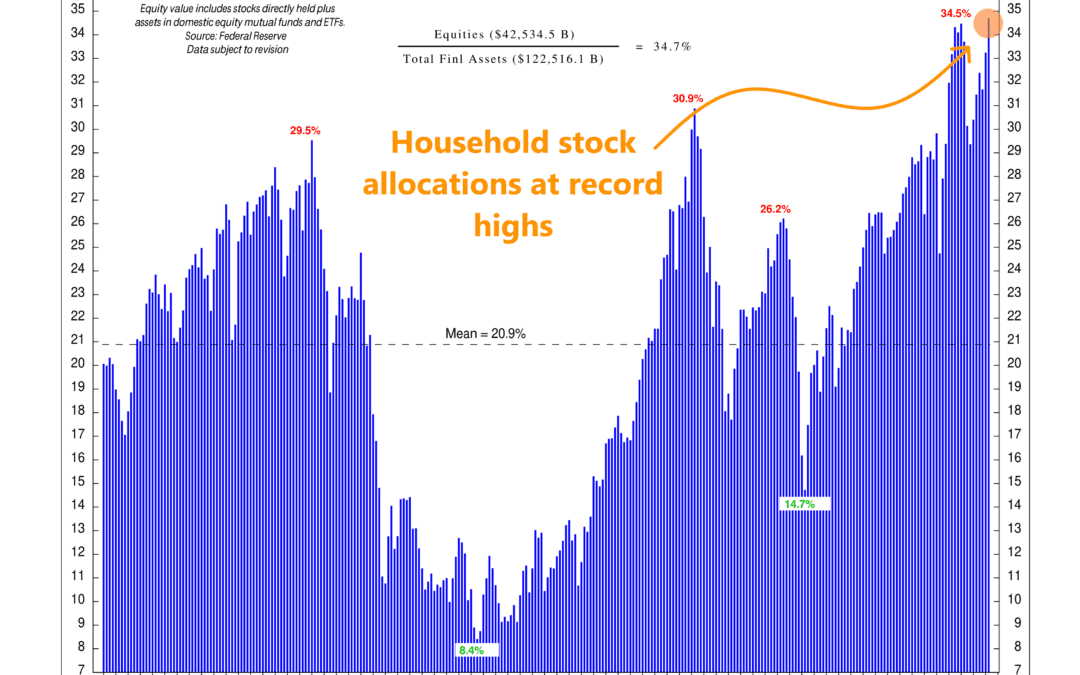

Stocking Up

“I’m all in!” According to this week’s featured indicator, that’s what investors have been saying about the stock market recently. Specifically, the indicator above measures stocks as a percentage of household financial assets, revealing how much households are...

Financial Focus – June 19th, 2024

Tune into this week’s episode of Financial Focus, where Nate Kreinbrink and Andy Fergurson discuss the recent rise in IRS-related scams and share crucial tips on how to protect yourself from fraudsters impersonating government agencies.

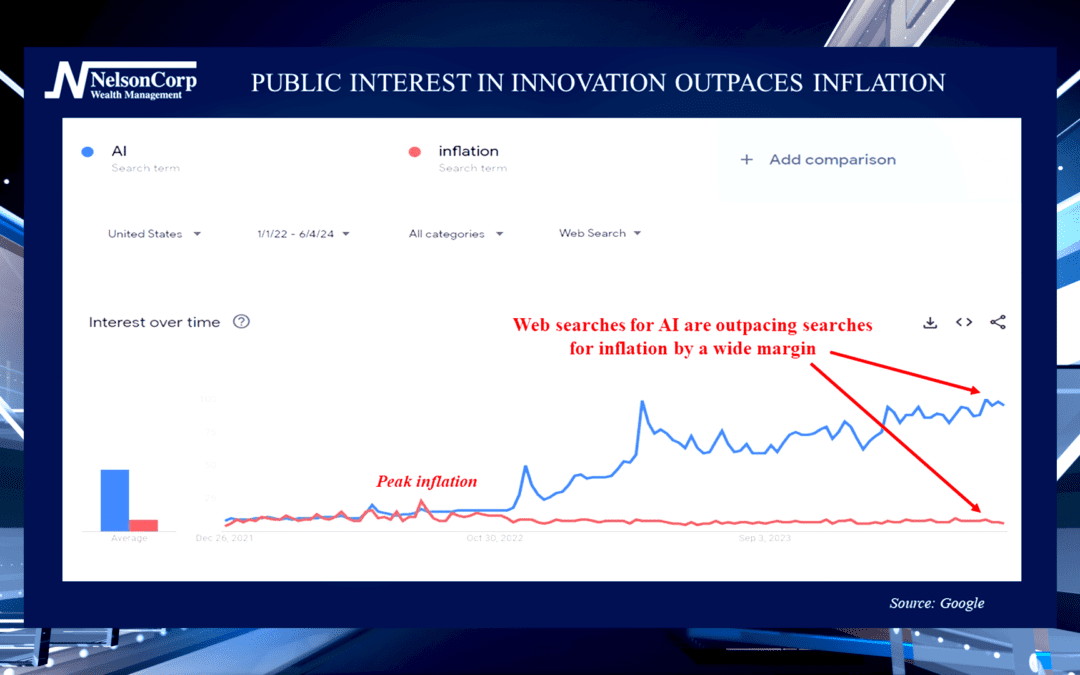

Innovation

There are many topics that affect financial markets at different times of the year. Nate Kreinbrink is here to share the themes he is currently watching and what this data means for viewers’ investments.

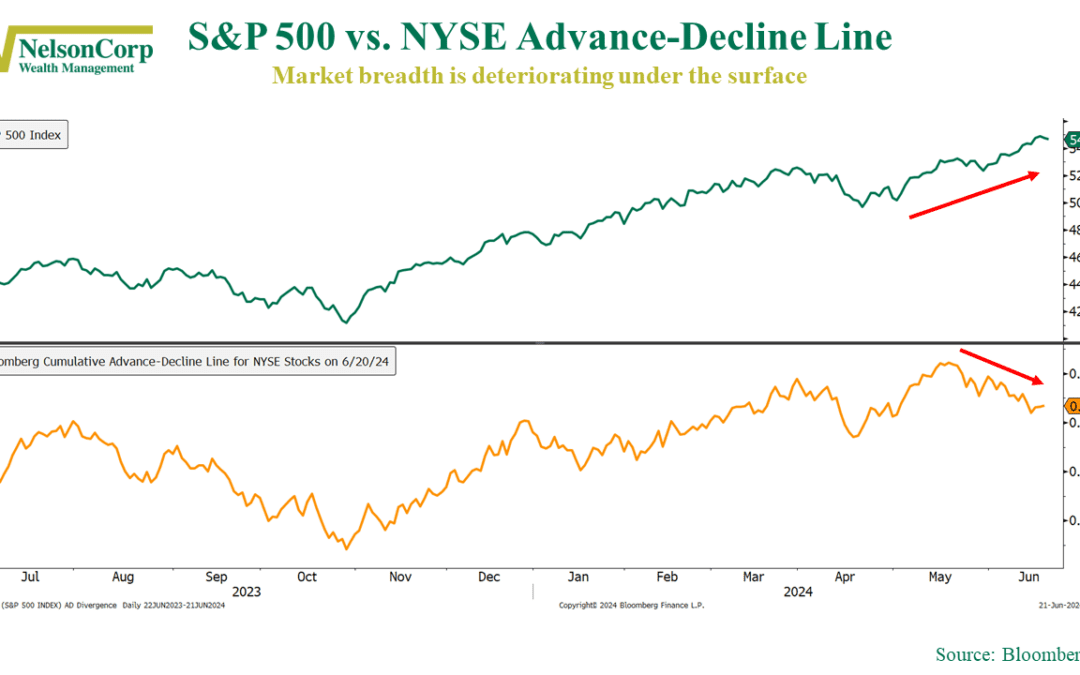

The Two Buoys

On the surface, the stock market looks pretty good. But under the surface, we find that just two key areas are keeping the market afloat. Check out this week’s commentary to find out more.

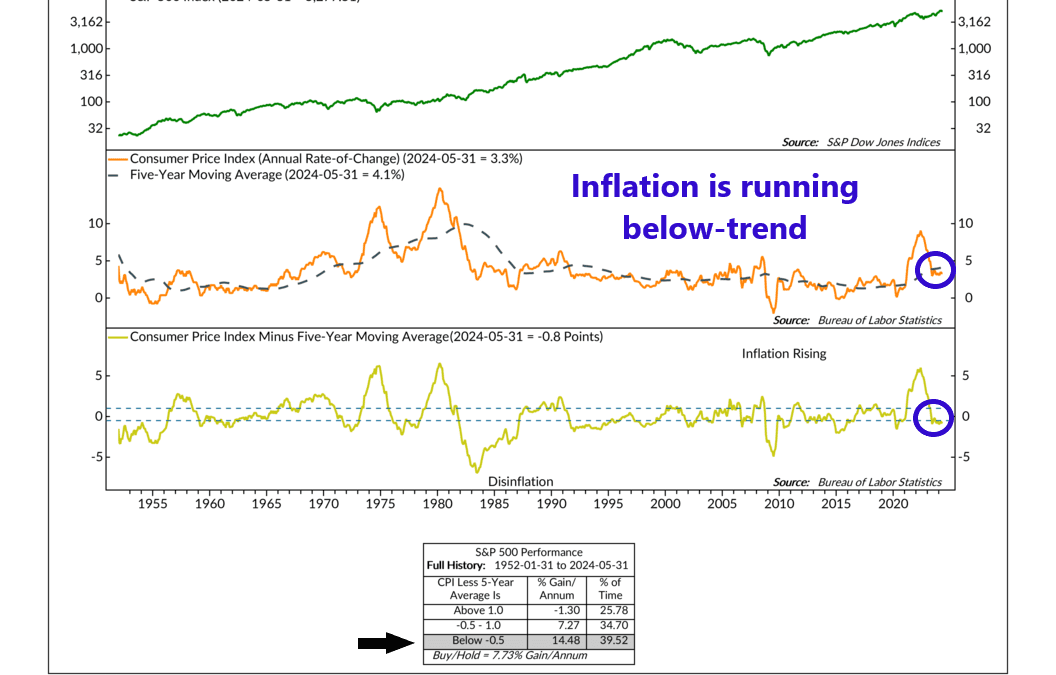

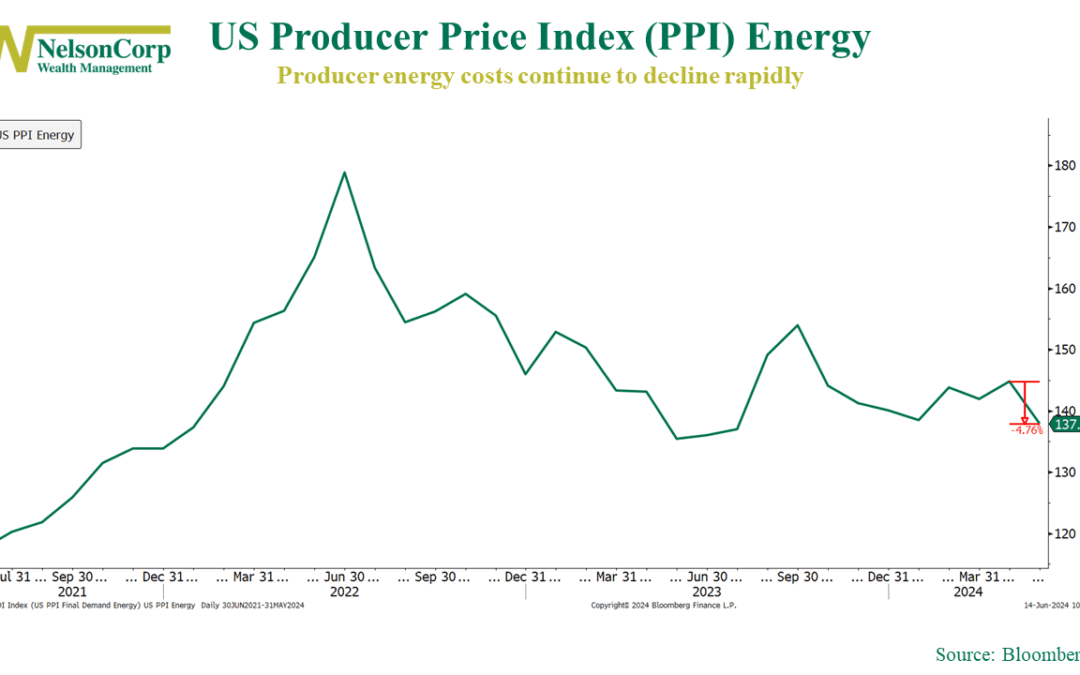

Getting Cheaper

We saw a lot of good news on the inflation front this week. The May Consumer Price Index (CPI) showed a broad cooling in prices, and then we found out that the Producer Price Index (PPI) unexpectedly declined by the most in seven months last month. The big...

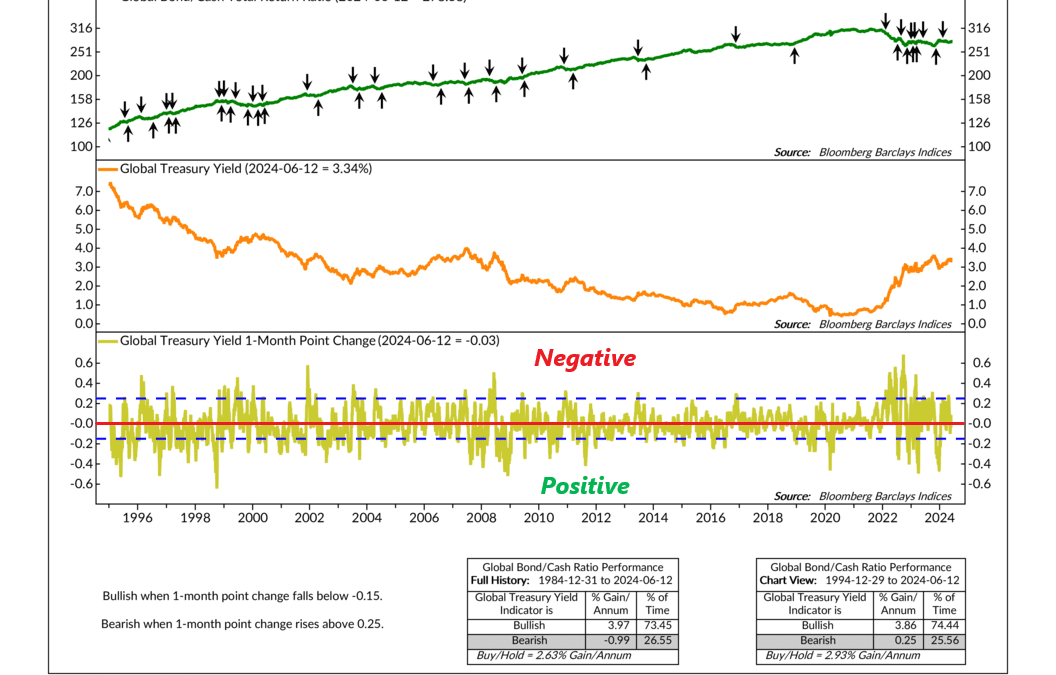

Treasury Torque

This week’s featured indicator is kind of like a wrench. When you turn a wrench, it creates a force called torque that helps move an object. But in this case, global treasury yields are the wrench, and the object being moved is the global bond/cash ratio. Let...

Financial Focus – June 12th, 2024

In this week’s episode of Financial Focus, Nate Kreinbrink discusses the upcoming two-day meeting at the Federal Reserve and its impact on interest rates, and also delves into the topic of social security benefits.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AR, AZ, CA, CO, CT, FL, GA, HI, IA, ID, IL, IN, LA, MA, ME, MI, MN, MO, MT, NC, NE, NJ, NM, NV, NY, OH, OR, SC, SD, TN, TX, UT, VA, WA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.