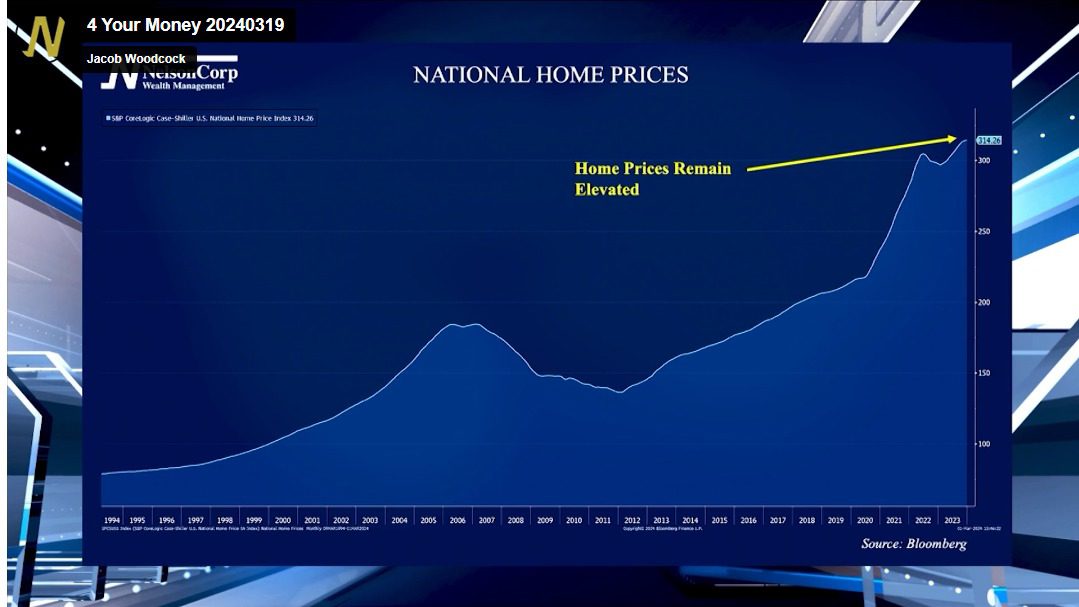

Home Prices

Most people expected high interest rates to hurt home prices. James Nelson is here to tell us how home prices have fared since we seem to be at the peak of the interest rate cycle.

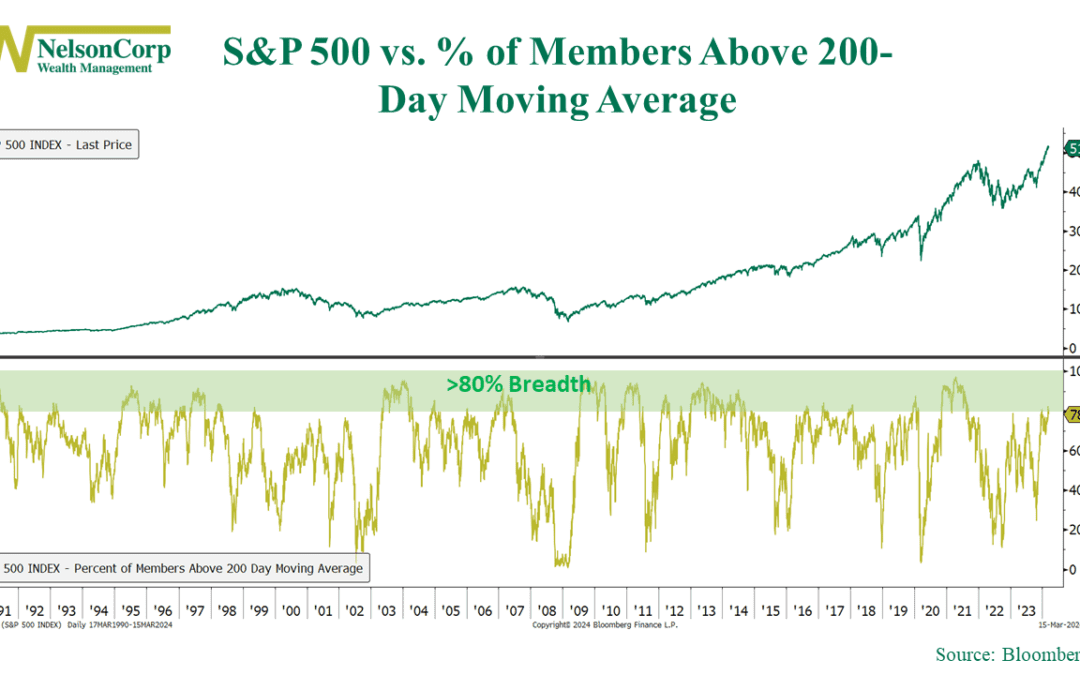

A Breadth of Fresh Air

In this week’s commentary, we discuss the recent expansion in stock market breadth and what it means for the market’s long-term health.

The New Oil

Some have said semiconductors are the new oil. The stock market agrees. Our featured chart this week shows the ratio of the Philadelphia Stock Exchange Semiconductor Index to the S&P 500 Index. This essentially illustrates how the semiconductor sector has...

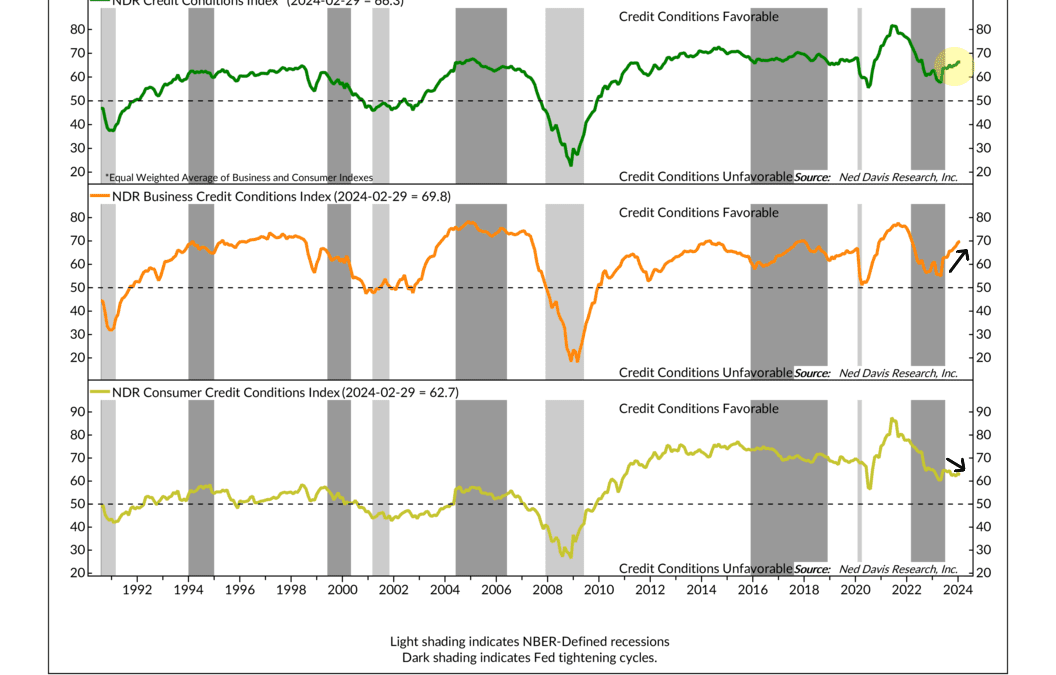

Cozier Credit

Good news on the financial front: credit conditions are on the upswing! According to the NDR Credit Conditions Index, our spotlight indicator this week, things are looking brighter for businesses and individuals looking to get loans or credit. What are credit...

Financial Focus – March 13th, 2024

In this week’s episode of Financial Focus, Nate Kreinbrink discusses the Federal Reserve’s fight to combat inflation and Medicare options for individuals turning 65.

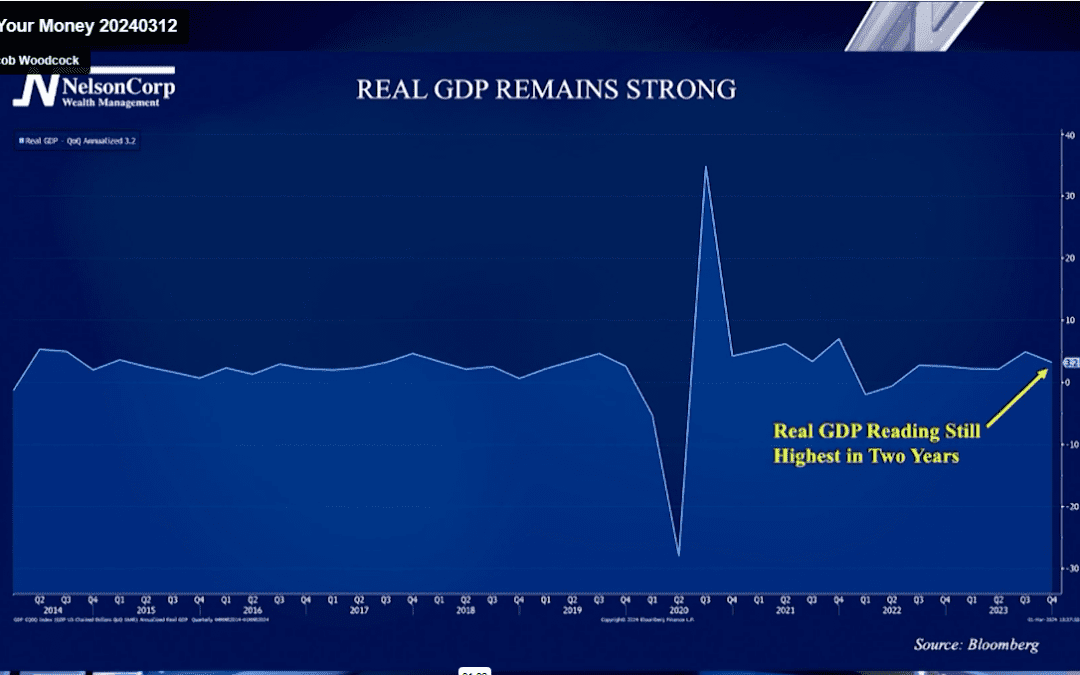

Economic Growth

Some people have been surprised at how well the stock market has performed so far this year. David Nelson joins us to share his thoughts on the first quarter activity.

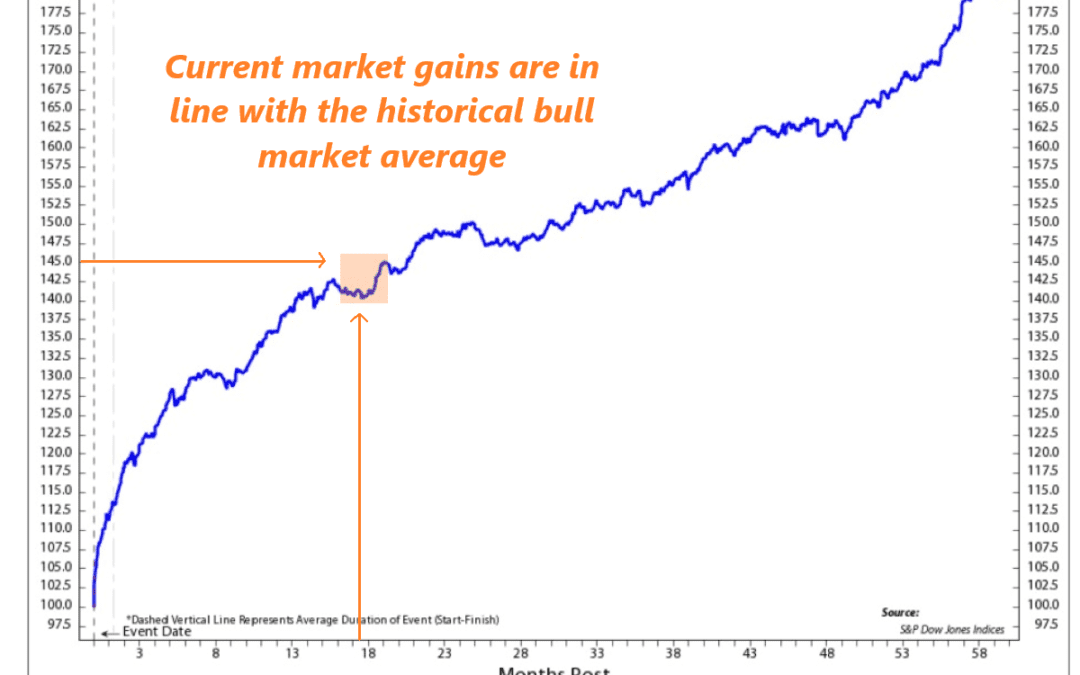

It’s Good to Be Average

They say you shouldn’t settle for average. But when it comes to bull markets, we say differently. Check out our latest weekly market commentary to find out why.

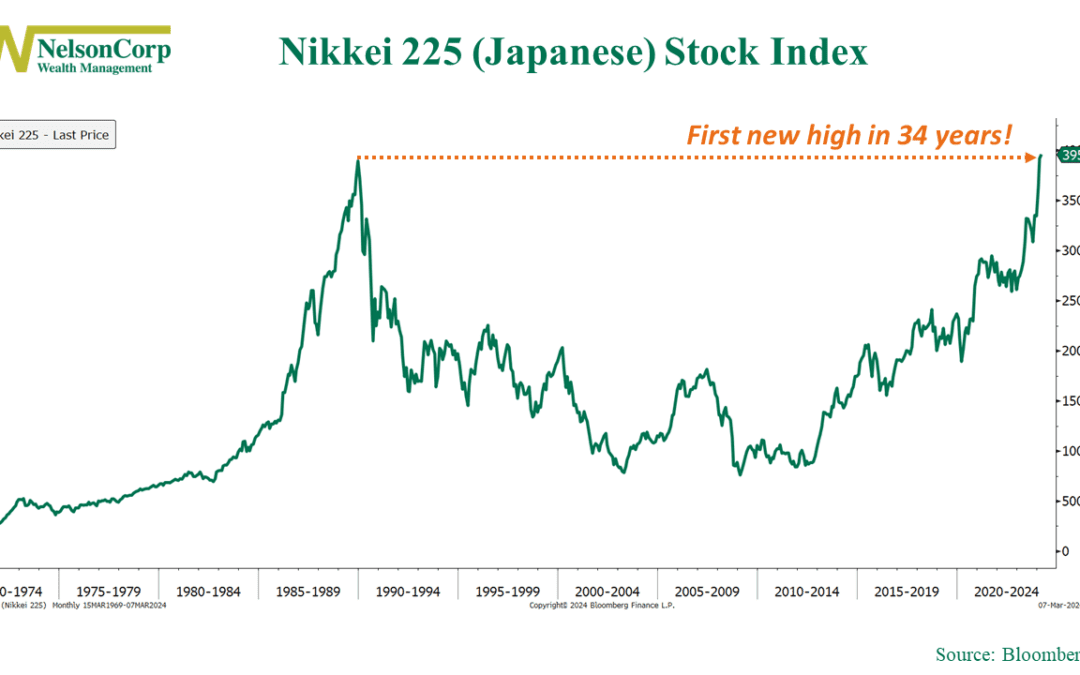

New High Nikkei

It’s been a while, but the Japanese stock market finally hit a new all-time high this month. It reminds me of that scene in the movie Titanic where the old woman who survived the tragic incident starts her story by saying, “It’s been 84 years…” Okay, maybe it hasn’t...

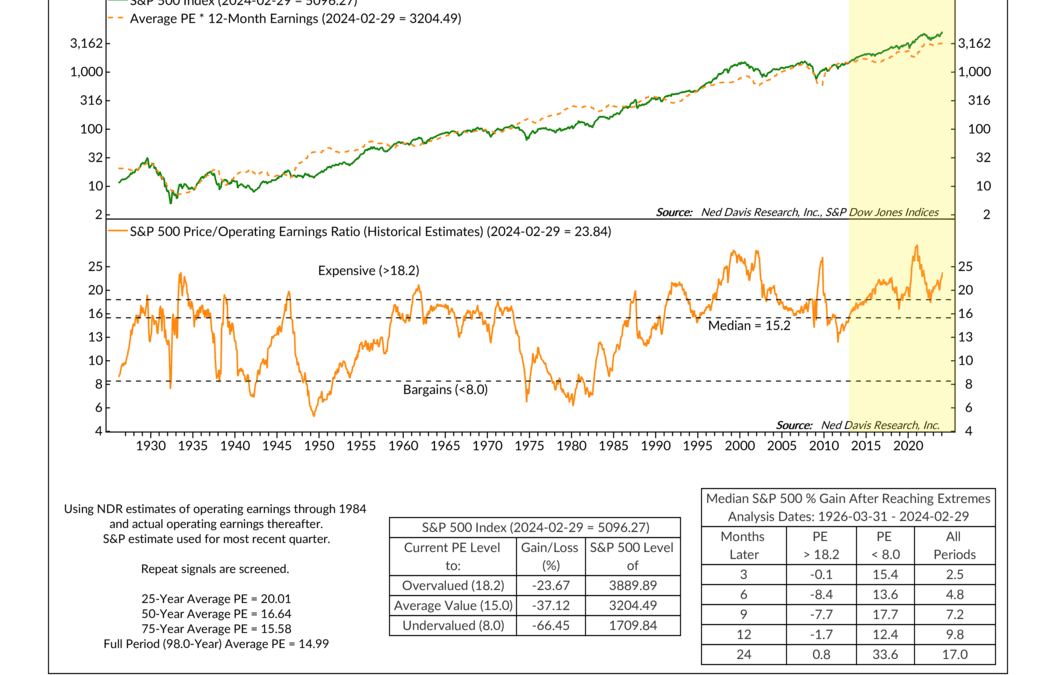

On the Rise

The stock market is rising, and valuations are, too. But what exactly do we mean by valuations? Well, it's all about a metric called the price-to-earnings ratio (P/E ratio). This ratio measures the price of a stock market index, like the S&P 500 Index,...

Financial Focus – March 6th, 2024

Tune into this week’s episode of Financial Focus, where David Nelson discusses the impact of Caitlin Clark on the University of Iowa, as well as the current state of the stock market and the Federal Reserve’s role in driving the market.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AR, AZ, CA, CO, CT, FL, GA, HI, IA, ID, IL, IN, LA, MA, ME, MI, MN, MO, MT, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WA, and WI. No offers may be made or accepted from any resident outside the specific states referenced.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.