Risk Off

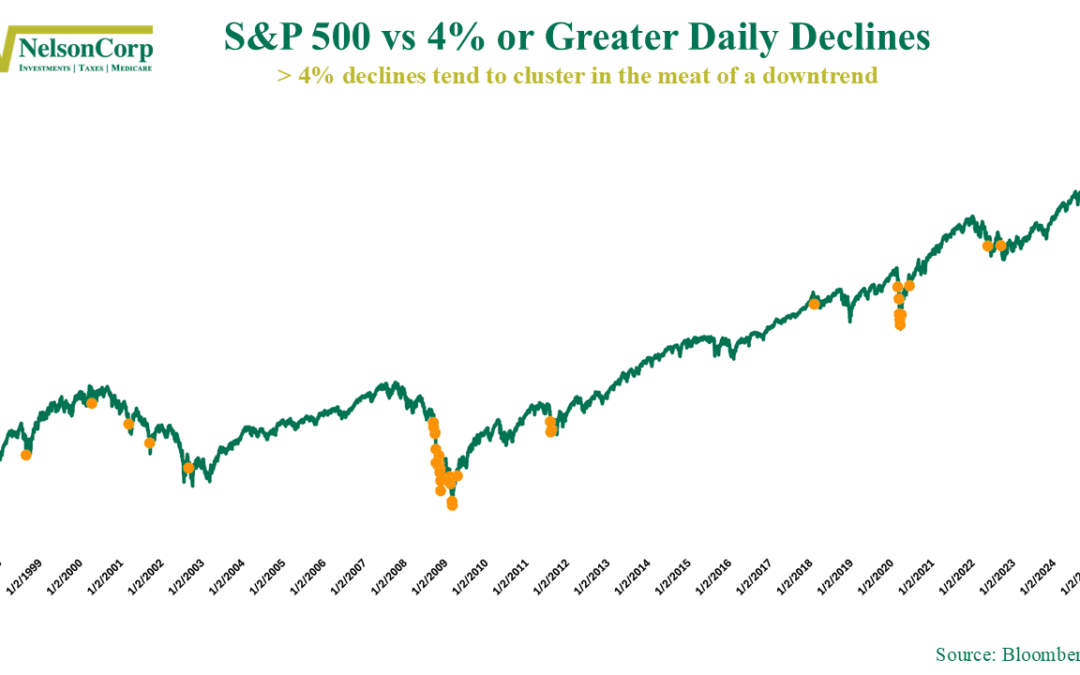

The S&P 500 got slammed to close the week, dropping over 4% on Thursday and then following that up with another bruising decline on Friday. The two back-to-back haymakers left markets reeling and investors wondering: Is this the bottom—or just the beginning?

Tariff Turbulence

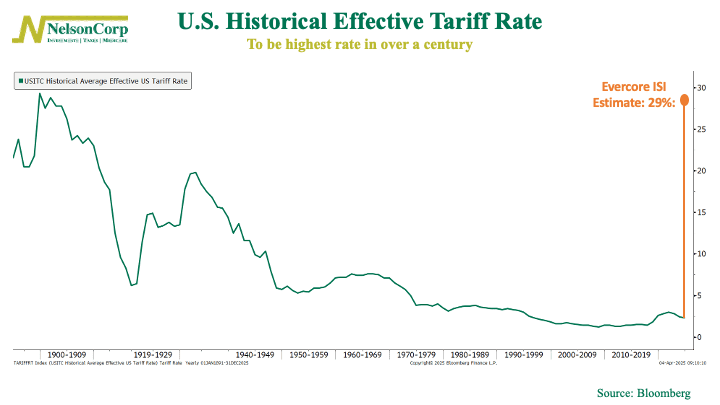

If you thought tariffs were a relic of early American economic policy, think again. Under President Trump's proposed "Liberation Day" policy, the U.S. is set to see its effective tariff rate hit 29%, the highest level in over a century. That’s according to an...

Weak Foundation

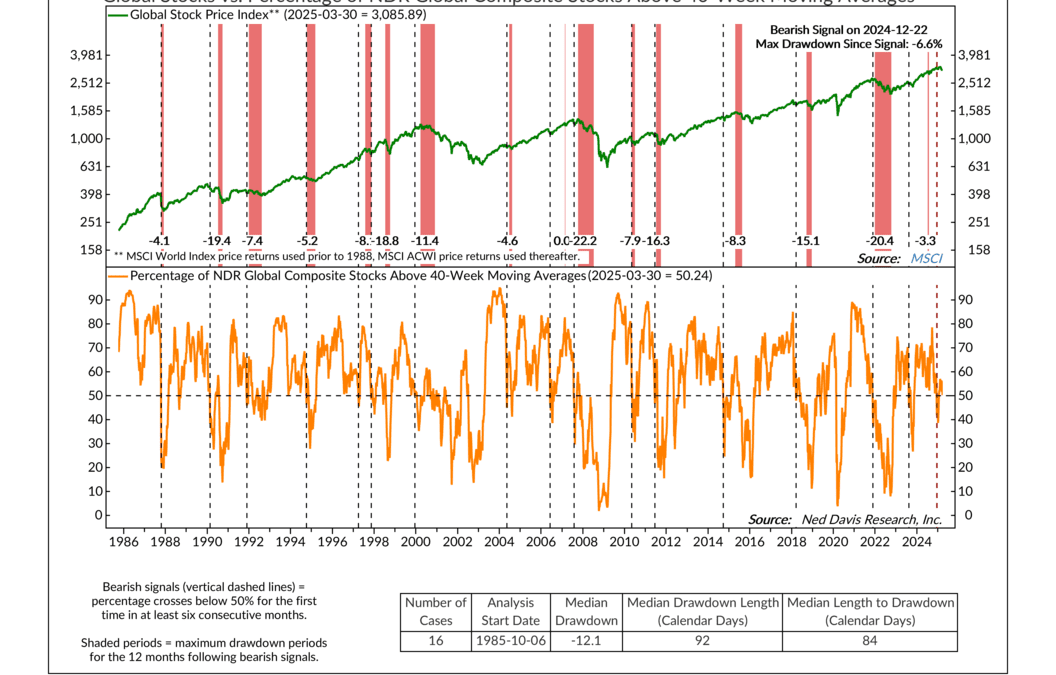

Global stocks are having a rough week. After a strong start to the year, markets have stumbled—hard. The selling pressure has been widespread, and it’s hitting many of the biggest names that have been propping things up. It’s starting to feel like a building...

Financial Focus – April 2nd, 2025

In this week’s Financial Focus, David Nelson reflects on the market’s recent volatility, recession risks, and the impact of tariffs and political uncertainty. David explains how his team is navigating the noise with defensive positioning and emphasizes the importance of focusing on fundamentals over headlines.

Dollar Dip

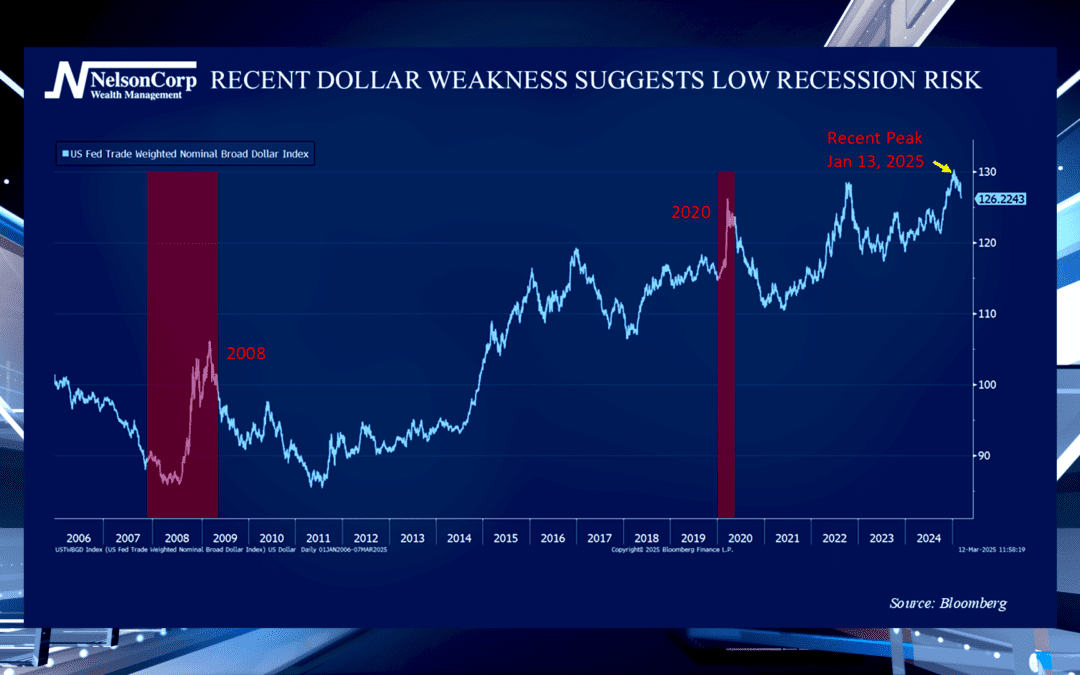

The US dollar had a strong finish in 2024 but has been weakening since late January. Nate Kreinbrink shows us how investors usually rush to the dollar for safety when the markets become nervous.

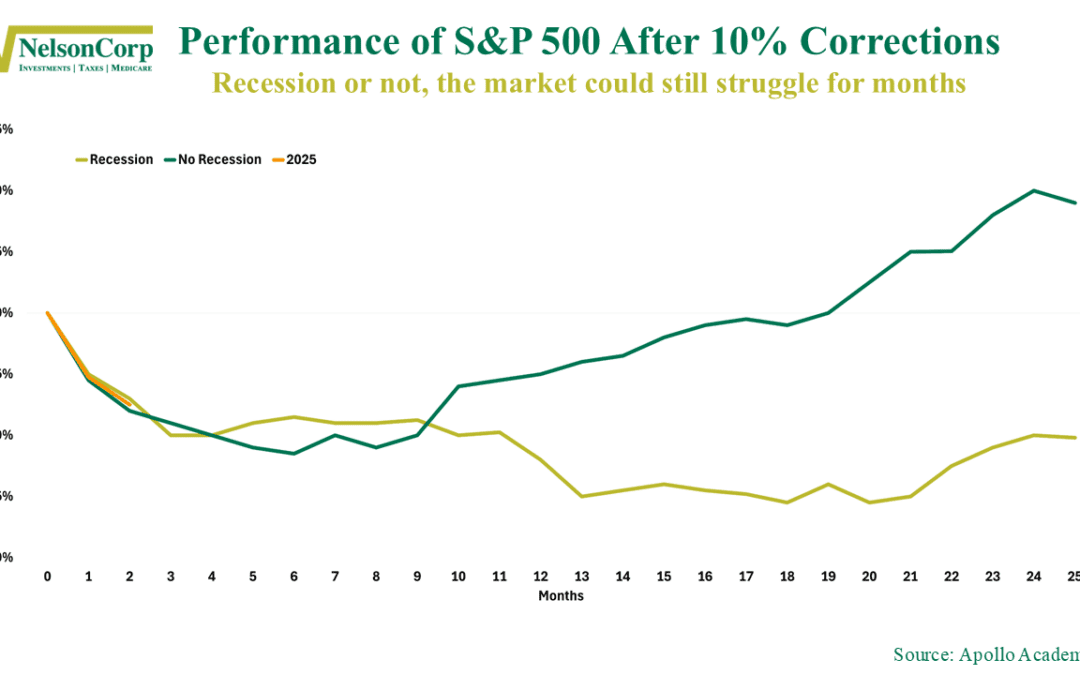

Correction Hangover

The market’s still feeling the pressure—and history says the hangover might just be getting started. One key chart and a fresh bearish signal suggest this slump could stick around longer than most expect. Check out this week’s commentary for more!

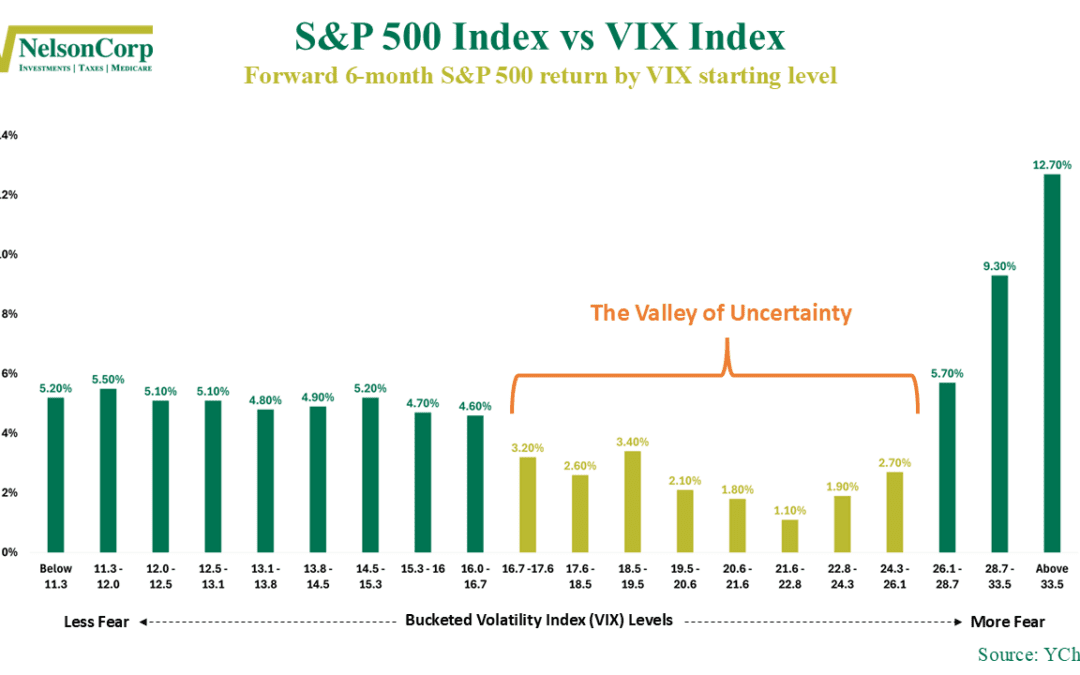

The Valley of Uncertainty

If you’ve felt like the market’s been spinning its wheels lately, this week’s featured chart might explain why. It looks at the VIX Index—Wall Street’s so-called “fear gauge”—and shows how the S&P 500 tends to perform over the next six months depending on...

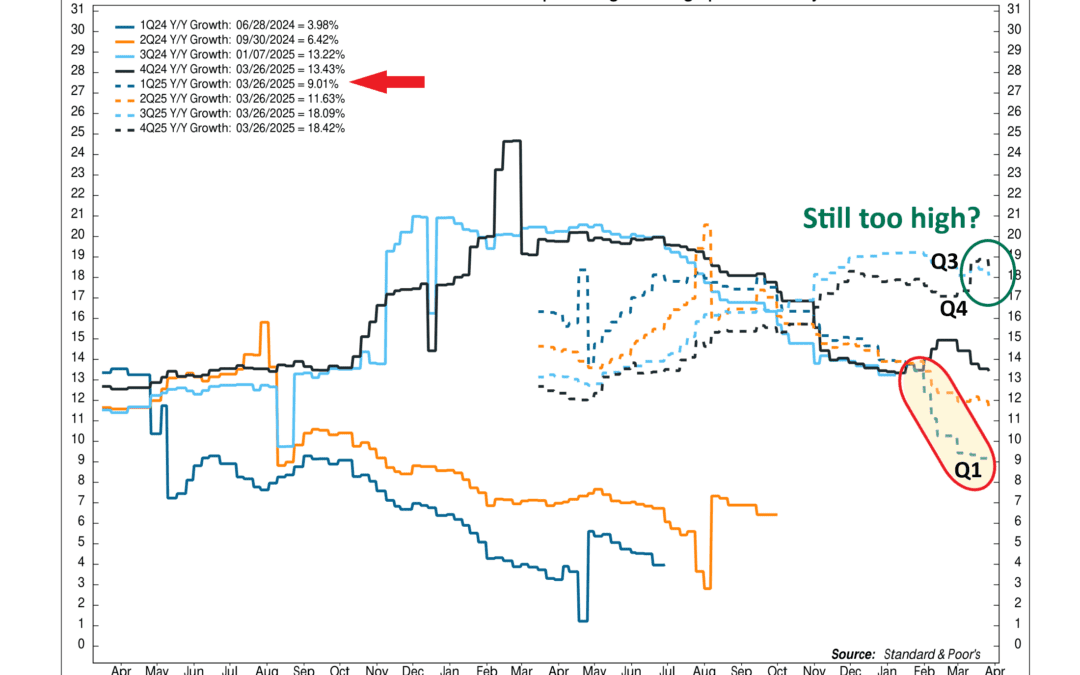

What Did You Expect?

“Downward revision” is one of the most common phrases you'll hear during earnings season. It’s a polite way of saying: "We got a little too optimistic." This week's indicator looks at how much those revisions are happening—and how much still might be left to...

Financial Focus – March 26th, 2025

This week’s Financial Focus highlights key Medicare enrollment steps for those nearing age 65, including timelines, automatic vs. manual enrollment, and the importance of applying early to avoid penalties or gaps in coverage. Nate and Mike emphasize tailoring decisions to each person’s specific situation and encourage listeners to seek guidance to better navigate the process.

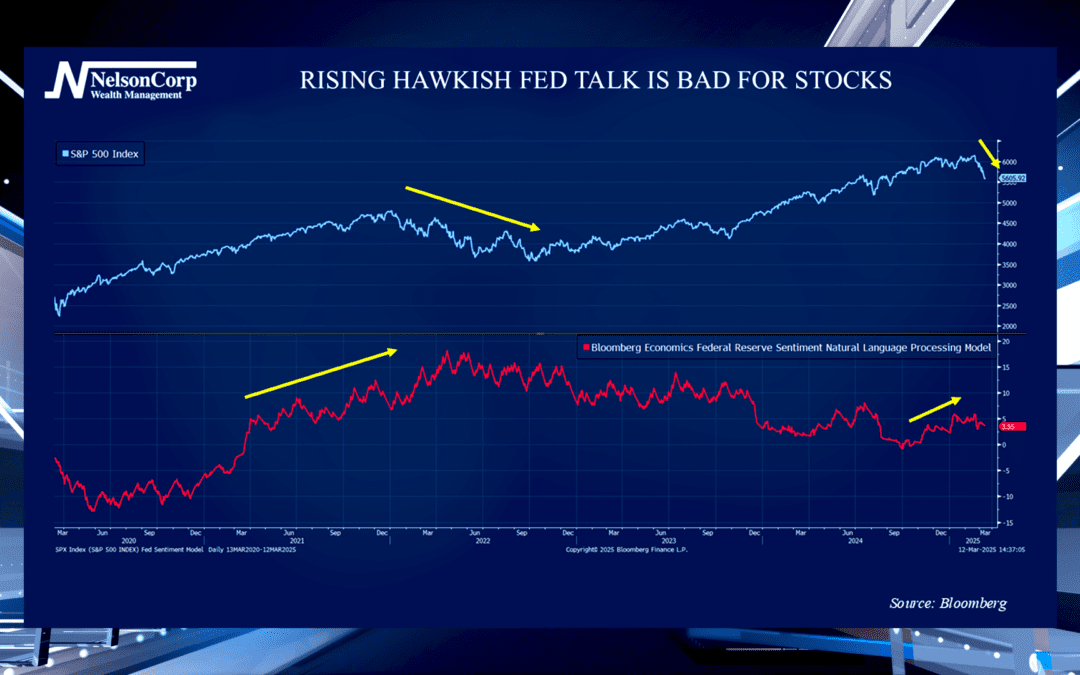

Hawkish Talk

Investors and the market have been looking for guidance from the Federal Reserve lately. David Nelson is here to explain how the Fed’s talk affects Wall Street and viewers’ investments.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.