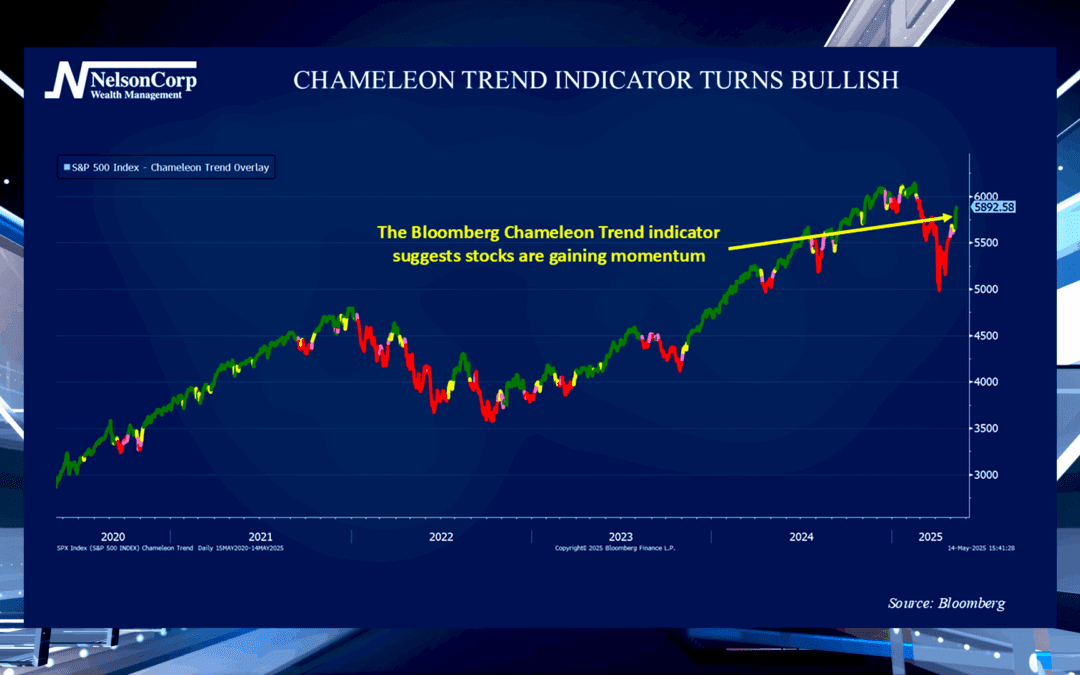

Momentum Swing

The market’s been riding a big momentum shift lately. Dive into this week’s commentary for a closer look at what’s driving the action.

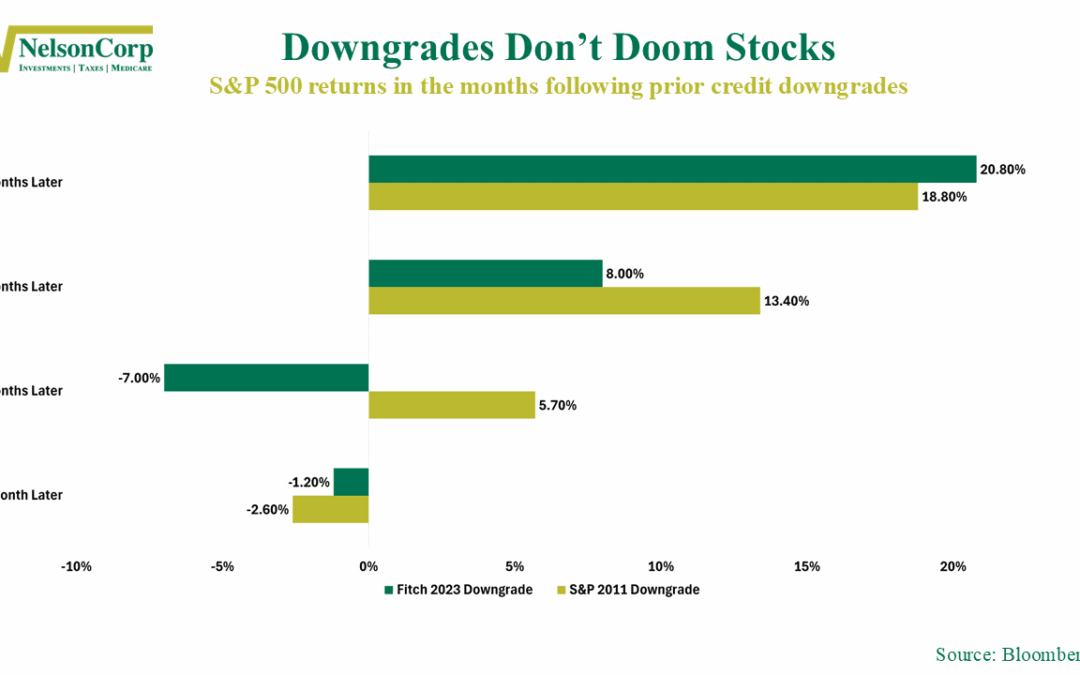

Downgrade and Chill

Moody’s just hit the U.S. with a downgrade—should you be worried? History says the real story might be what happens after the headlines fade.

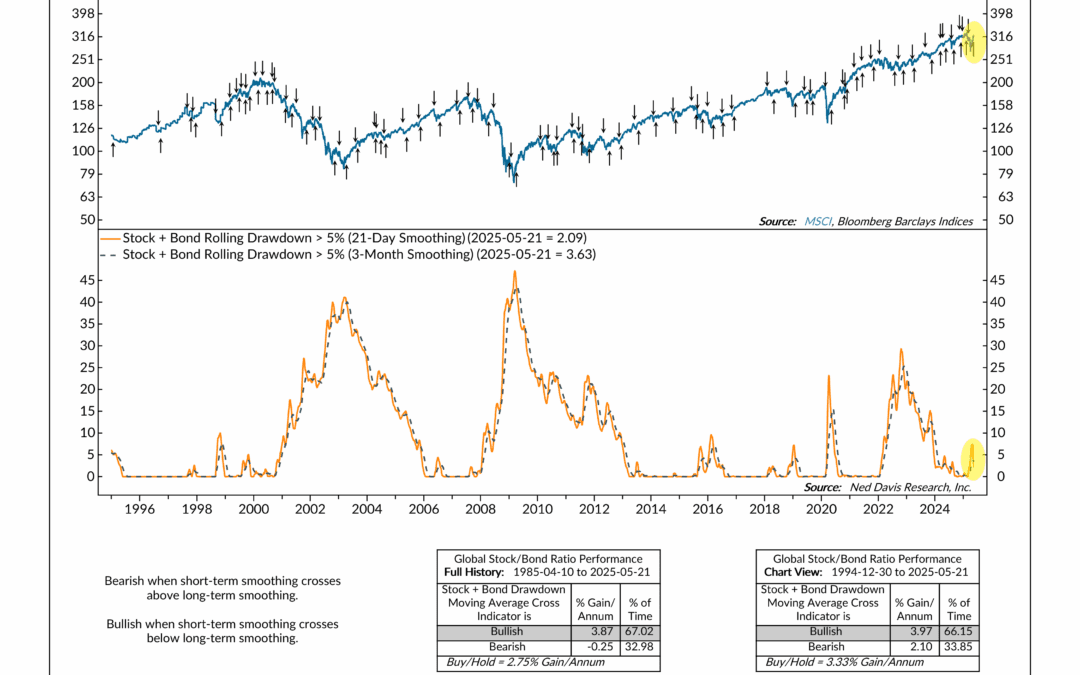

Drawdown Dynamics

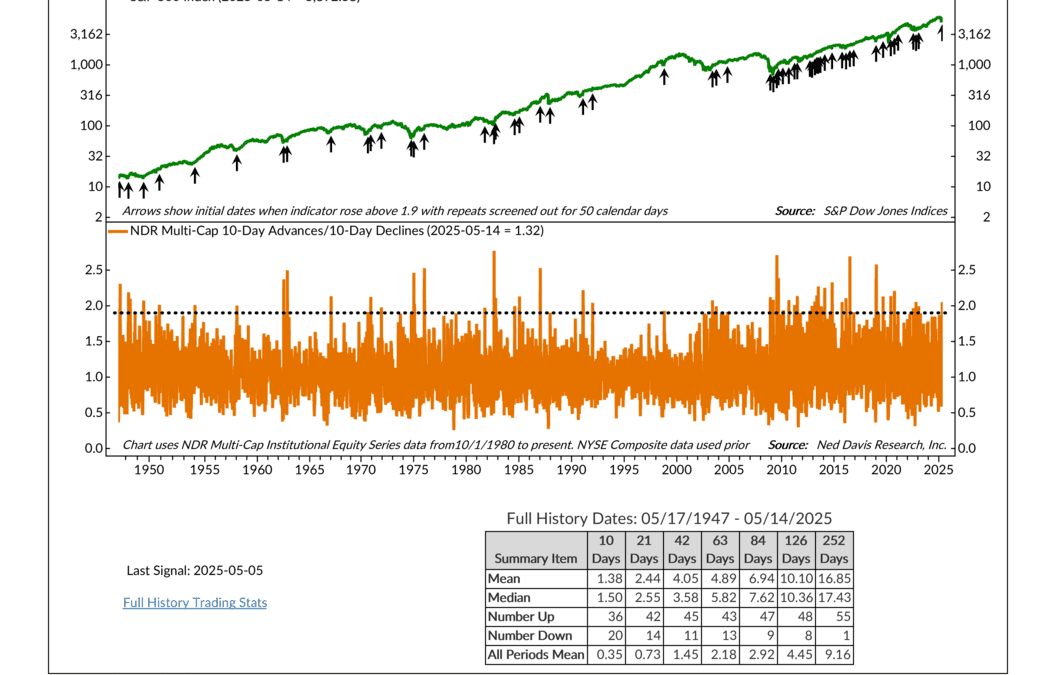

Stocks and bonds came under pressure earlier this year—but this week’s indicator suggests the worst of the pain might be behind us. A new bullish signal just triggered, and history shows it often shows up right as markets begin to recover.

Financial Focus – May 21st, 2025

Tax season may be over, but the planning season is just getting started. Tune in as Nate and Andy break down why the months ahead could bring big opportunities—and big changes—for your tax strategy.

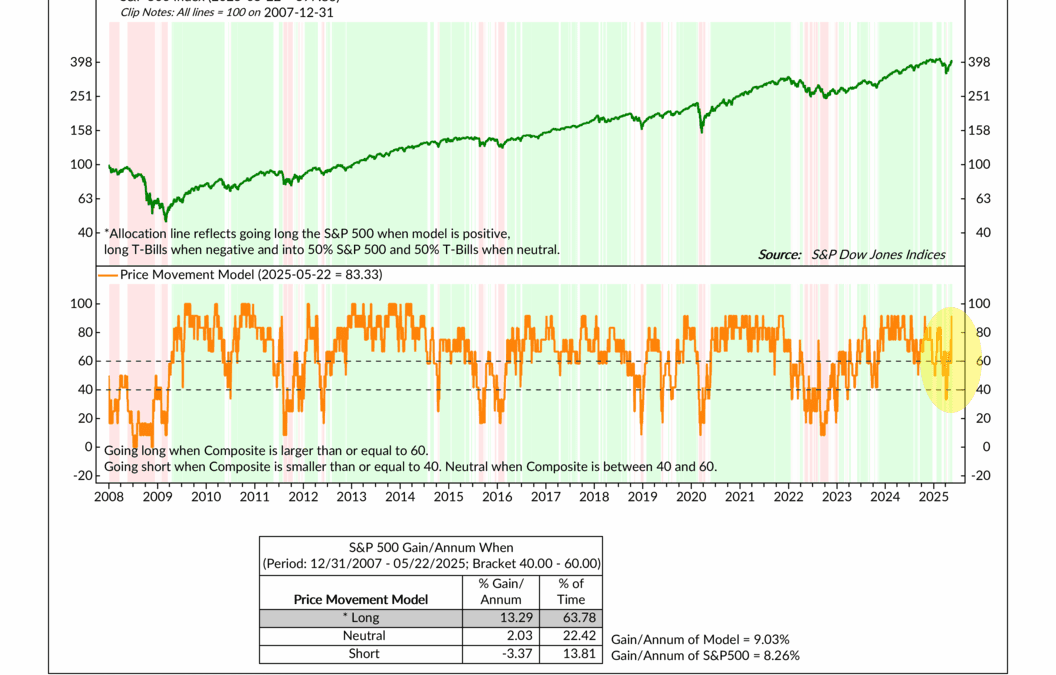

Chameleon Trend

The markets have yo-yoed quite a bit this month. David Nelson shares new data showing positive momentum that hopefully results in a promising end to May.

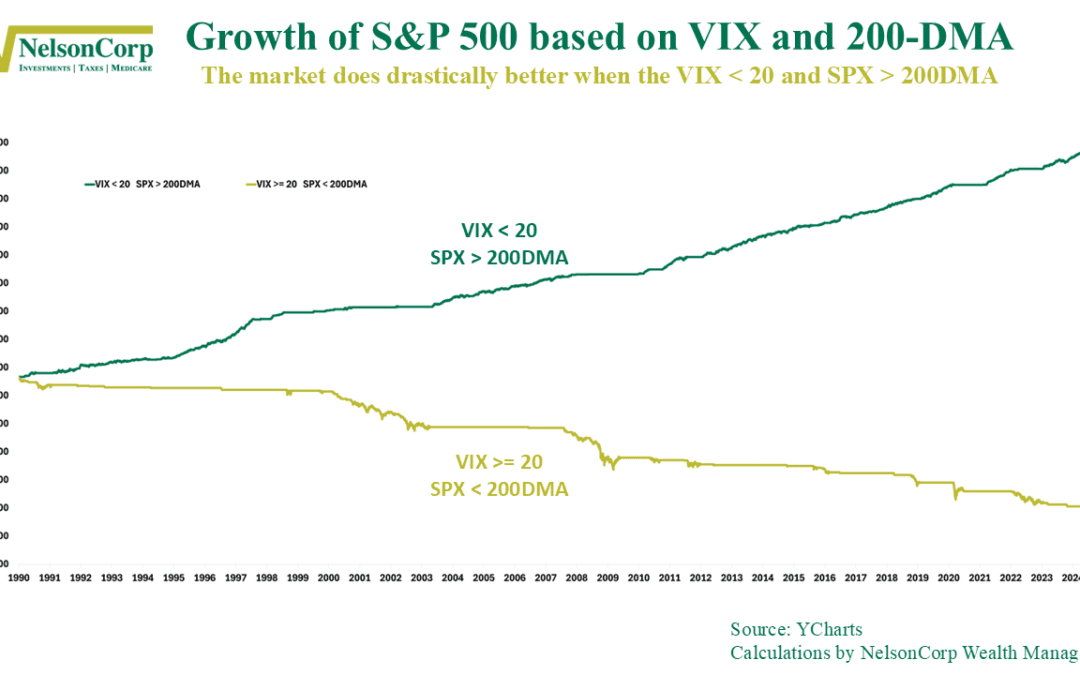

Two Paths

The market tends to follow one of two paths—either calm and climbing, or volatile and falling. After last week, it looks like we’ve just stepped back onto the better one.

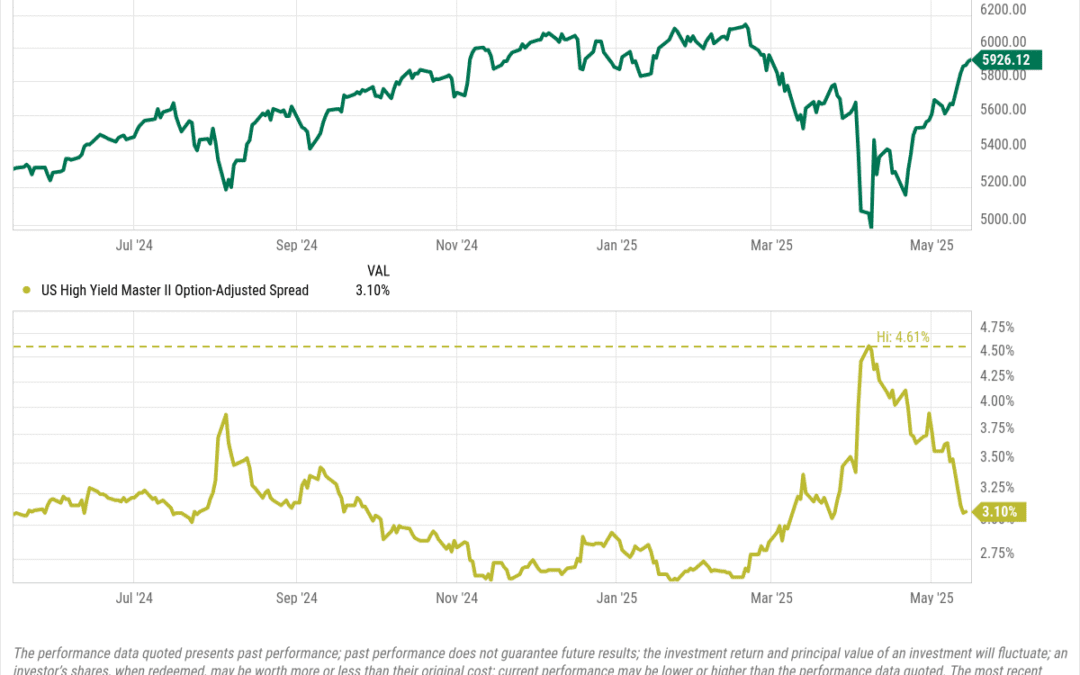

Credit Spreads Signal Calm

After a sharp spike in early April, credit spreads are once again signaling smooth sailing in the bond market—and by extension, the stock market. The chart above shows U.S. high yield spreads tightening sharply—down 151 basis points since peaking at 4.61% on...

Thrust!

Houston, we have thrust! That’s right, this week’s indicator is all about thrust. But I’m not talking about a rocket ship—I’m talking about the stock market. Specifically, I’m referring to market breadth and how it can be used to generate an upside “thrust”...

Financial Focus – May 14th, 2025

This week’s Financial Focus encourages young people—especially recent grads and students with summer jobs—to start saving early. Nate Kreinbrink highlights Roth IRAs as a strong option for young savers and reminds listeners that forming good financial habits now can make a big difference down the road.

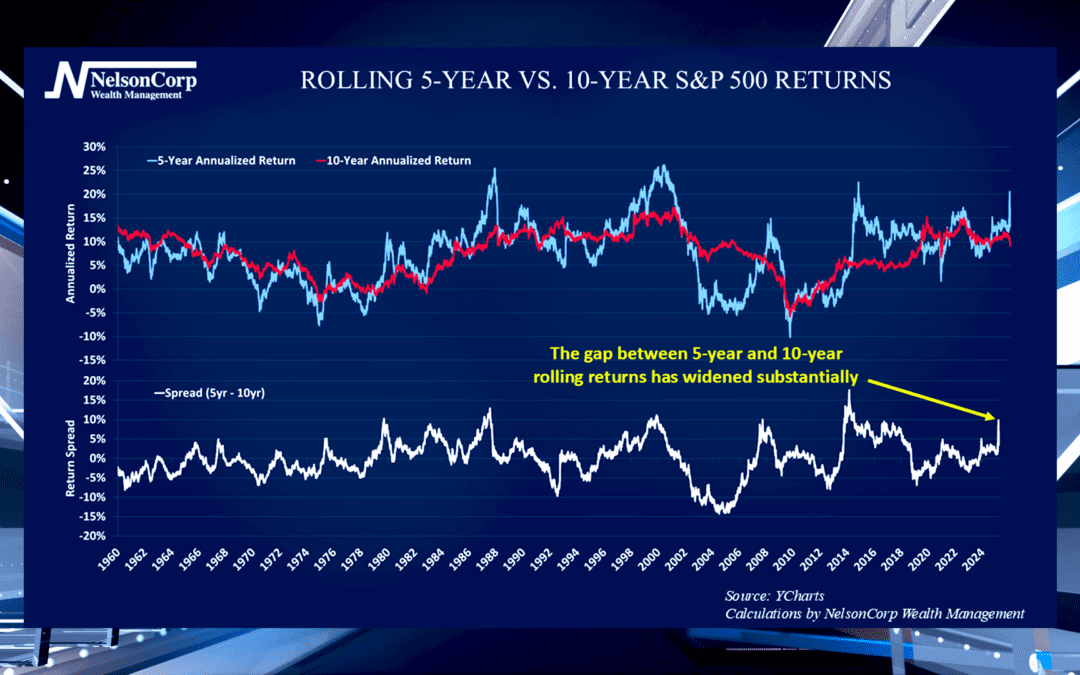

Rolling Returns Radar

The stock market has performed well the last few years, but this year’s off to a rough start. Nate Kreinbrink joins us to discuss how a slower stretch after a strong run is normal for the markets.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.